Exploring BlackRock’s BUIDL: The Future of Institutional Finance

The financial sector is in the midst of a dramatic transformation, heavily influenced by rapid technological advancements and increasing environmental awareness. As investment landscapes evolve—often characterized by volatility yet offering significant rewards—traditional financial institutions are seeking innovative routes. Among these, BlackRock, a leading asset manager known for its investment, advisory, and risk management solutions, has stepped into the crypto and blockchain arena.

What is BUIDL?

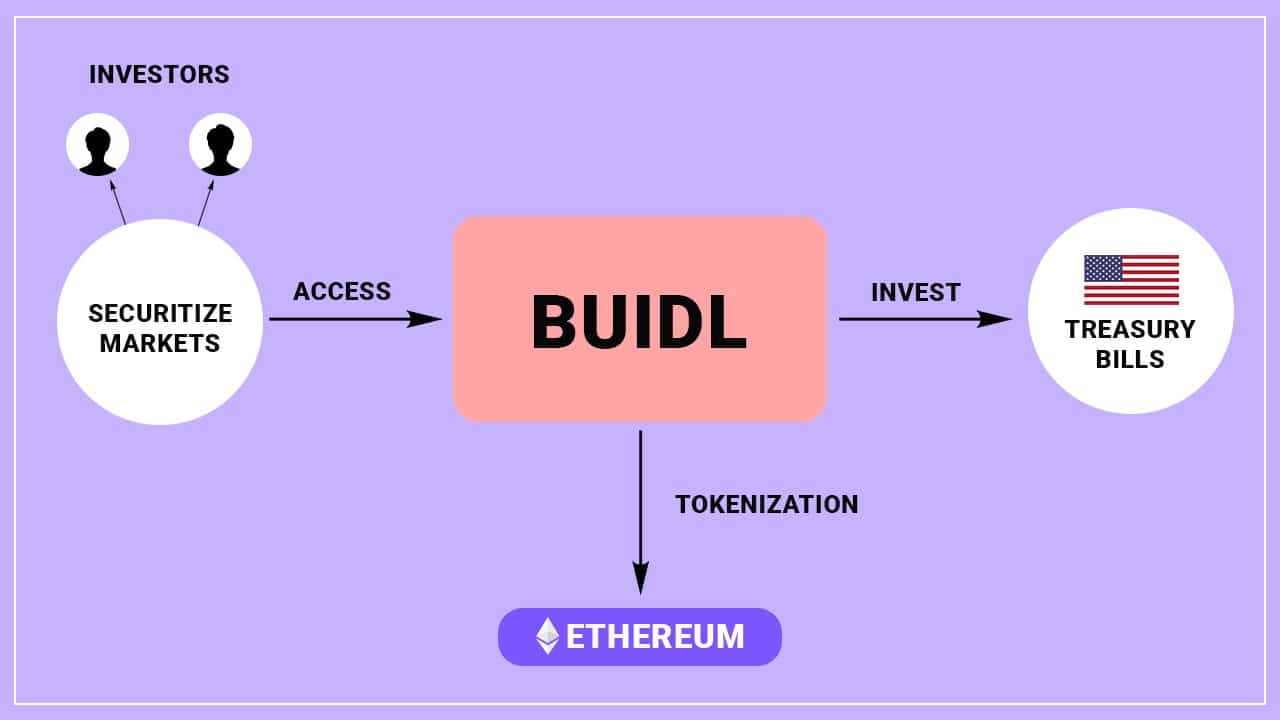

Introducing the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), this is BlackRock’s inaugural tokenized fund designed specifically for institutional investors. Launched in March 2024 in collaboration with Securitize, BUIDL represents a significant milestone in bridging traditional investing practices with groundbreaking technology. Operating on the Ethereum blockchain, BUIDL tokenizes shares of a conventional money market fund, making them accessible and tradable as digital assets. Each token denotes a fund share, providing real-time transparency and instilling trust among investors.

In March 2025, BUIDL expanded its capabilities by becoming available on the Solana blockchain, showcasing its adaptability and the growing influence of multi-chain technology in financial products. The fund invests primarily in high-quality short-term U.S. government securities, offering a stable, low-risk investment alternative.

Key Functionalities of BUIDL

BUIDL is not just another financial product; it embodies several key functionalities aimed at enhancing investor experience and engagement with digital assets.

Tokenization on Ethereum

By utilizing the Ethereum blockchain, BUIDL promotes real-time auditing of fund transactions. This feature significantly boosts investor trust and transparency in the fund’s operations. Tokenization allows seamless interaction with blockchain-enabled financial systems, setting a precedent for future financial innovations.

High-Quality Investments

Backed by U.S. government securities, BUIDL is designed to maintain liquidity and mitigate risk. These investments provide a consistent dividend stream, making BUIDL an attractive option for institutional investors looking for stable, low-risk exposure to the evolving blockchain landscape.

Digital Accessibility

BUIDL is accessible through various digital asset trading platforms, such as Securitize Markets. This wide-ranging accessibility enables institutions to engage with the blockchain ecosystem without facing technological hurdles, effectively broadening the fund’s appeal.

BlackRock’s Role in Crypto Market

BlackRock’s entry into the cryptocurrency sector transcends the BUIDL fund. The firm has been proactive in this space, launching a spot Bitcoin exchange-traded fund (ETF) that has drawn considerable investments. CEO Larry Fink’s acknowledgment of Bitcoin as a legitimate asset class signifies a meaningful shift in institutional attitudes toward cryptocurrency, indicating a stronger foothold for digital assets in mainstream finance.

BUIDL’s Role in Institutional Finance

BUIDL serves as a crucial conduit between traditional finance and the digital realm. It provides those cautious institutional investors with a reliable, tokenized fund backed by stable U.S. government assets. This design introduces a low-risk investment alternative while leveraging blockchain’s inherent transparency.

Offering a practical introduction to blockchain technology, BUIDL allows financial institutions to explore this innovative landscape while minimizing risks. The fund’s structure encourages traditional finance players to experiment with blockchain, fostering greater trust and understanding within the digital asset market. The rise of BUIDL may well motivate other asset managers to roll out their tokenized financial products, strengthening blockchain’s legitimacy in institutional finance.

How BUIDL Attracts Institutional Players

By tokenizing a familiar investment vehicle, BlackRock positions the BUIDL fund as an inviting entry point for institutions interested in the blockchain space. This hybrid strategy balances the need for security and regulatory compliance with the advantages of blockchain technology.

Moreover, BUIDL simplifies the investment process for institutions. By tokenizing assets on the Ethereum blockchain, BlackRock enhances availability and liquidity, thus attracting conservative investors who remain keen on the benefits that digital assets can offer.

Future of BUIDL

As part of BlackRock’s long-term strategy, BUIDL represents its intent to deeply integrate into the blockchain sector. The fund’s vision extends toward multi-chain interoperability, with plans to integrate with newly adopted networks like Avalanche, Polygon, and Arbitrum. This strategy significantly enhances its utility and accessibility for cross-chain investors.

The adaptability of BUIDL positions it as a model for future tokenized financial products. As the concept of tokenization garners mainstream popularity, BlackRock’s expertise and initiatives could pave the way for broader acceptance of such solutions, ultimately enhancing liquidity, efficiency, and inclusivity in institutional finance.

BUIDL encapsulates the convergence of traditional and digital finance, symbolizing a burgeoning future where both realms operate cohesively within the financial ecosystem. With its ongoing innovations and focus on technology, BlackRock’s BUIDL aims to redefine how institutional investors engage with the digital economy, marking a pivotal step toward an integrated financial future.