Ethereum (ETH) has been experiencing ongoing sideways momentum, with the price struggling to make any sharp gains. Currently trading around $2,476, the altcoin king has been unable to break through key resistance levels.

In the ever-evolving world of cryptocurrency, Ethereum has notably found itself stalled in a range that many investors find frustrating. This price stagnation has led to an increase in selling among key holders, signaling a lack of confidence among those who invested in ETH previously. The push for a bullish breakout seems to be losing steam, and market observers are keenly watching for any significant changes.

Ethereum Selling Rises

Recent trends in Ethereum’s exchange net position change indicate a disturbing flow of ETH into exchanges, a development many view as a bearish signal. In just the past five days, about 350,000 ETH—worth over $870 million—have been offloaded by investors. This surge in selling demonstrates a waning conviction among Ethereum holders, particularly from significant stakeholders, as their optimism appears to diminish.

This uptick in selling behavior can largely be attributed to the behavior of large holders. As the price of Ethereum fails to recover significantly, many are choosing to act on their sentiments rather than holding their positions in hope of better days. This behavioral trend is alarming, particularly because it underscores a potential shift in sentiment among long-term investors.

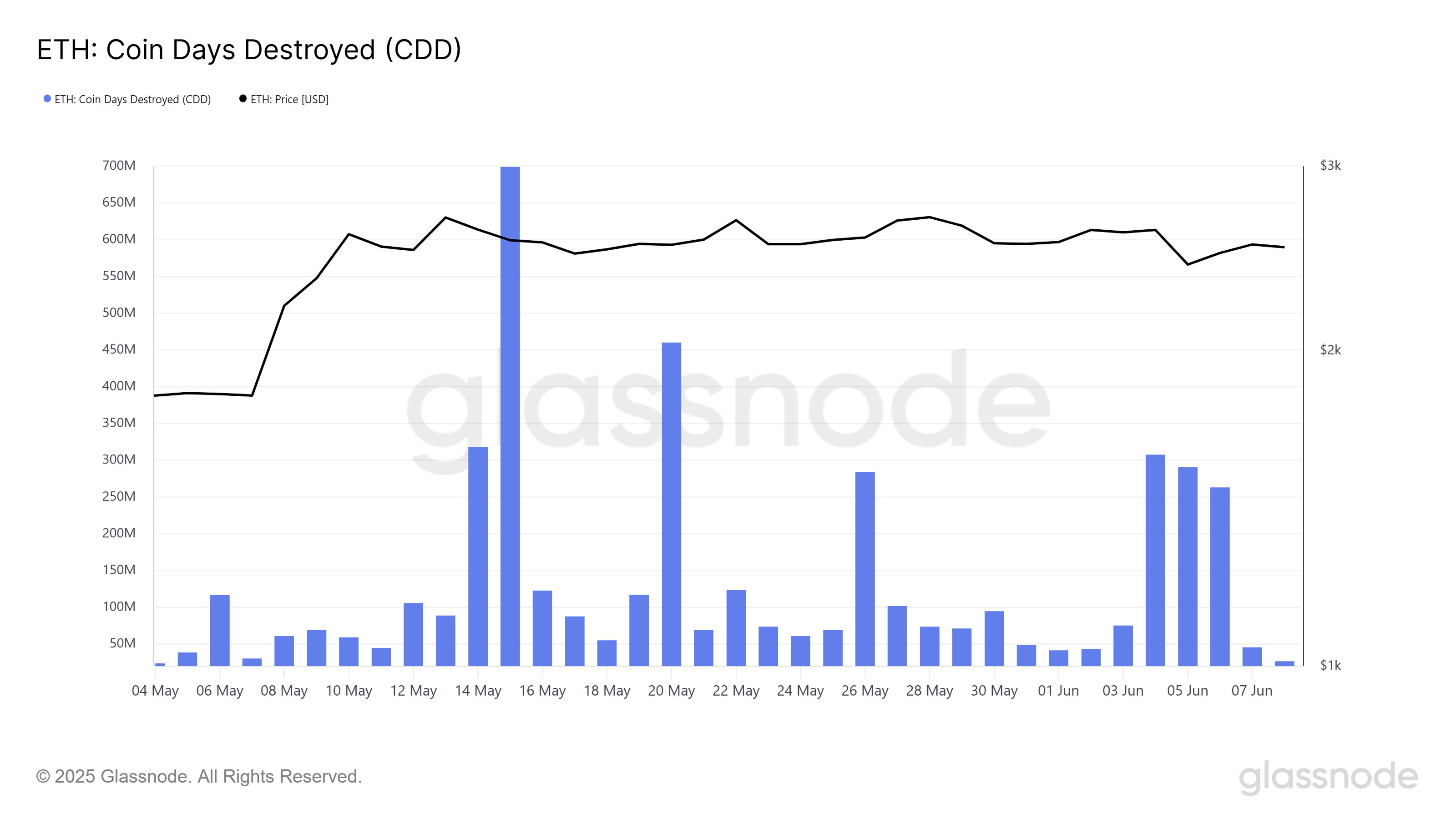

Adding to this complexity, the Coin Days Destroyed (CDD) metric illustrates an increase in selling activity among long-term holders (LTHs). Recent spikes in this metric suggest that these pivotal investors, who typically form the stable backbone of any asset, are beginning to liquidate their holdings. As they sell off their ETH, it is a bearish indication that even those who have once supported the coin might be losing confidence.

The potential implications of this selling activity could be quite severe. If leading holders continue to offload their positions, Ethereum may struggle to regain its footing in the market, possibly leading to further price declines. As the selling pressure builds, Ethereum risks prolonged stagnation, leaving its investors in a vulnerable position.

ETH Price is Holding On

As it stands, Ethereum is trading at around $2,485, maintaining a precarious position just above the local support level of $2,476. Given the prevailing market uncertainty along with mounting selling pressure, the price of ETH may be poised for a lackluster performance in the short term. The broader market dynamics remain volatile, leaving traders without clear guidance on future price movements.

Market experts warn that if Ethereum slips below its support level of $2,344, a further decline to $2,205 could be in the cards. Such downturns would exacerbate losses for investors and could further entrench a bearish market trend, leaving many to question Ethereum’s resilience in the current climate.

However, should Ethereum manage to hold its ground above the $2,476 support, there exists the potential for a rebound. If the selling pressure begins to decrease, ETH might find itself on an upward trajectory towards $2,606 or even $2,681. A reversal of market sentiment could indeed empower a rally, ushering in a newfound confidence in Ethereum’s price direction.

Disclaimer

This price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.