Ethereum has been making headlines lately, experiencing a robust recovery this week as it gained significant momentum, paralleling a broader uptrend in the cryptocurrency market. The ETH token surged to $2,800 on Thursday, marking a remarkable increase of over 30% from its lowest level this year. This impressive ascent includes a staggering 100% leap from its lows observed in April, leading many to re-evaluate the future of this cryptocurrency giant.

Ethereum Price Movement: Key Technical Indicators

Analyzing the daily timeframe, it’s evident that Ethereum has executed a strong rally in the past few days, escalating from a downbeat low of $2,116 in June to its current position around $2,752. This upward trajectory has seen Ethereum touch the 50% Fibonacci Retracement level, a critical point often indicative of potential price reversals and trends.

A defining characteristic of this rally is the emergence of a golden cross pattern, a significant bullish signal that occurs when the 50-day and 200-day Exponential Moving Averages (EMAs) intersect. This crossover typically indicates a potential long-term buy signal, drawing attention from both retail and institutional investors alike.

The Relative Strength Index (RSI), a key momentum oscillator, has surged to 64—the highest it’s been since June 11—suggesting that Ethereum may not yet be overbought, giving traders additional confidence. Other technical indicators, such as the MACD and the Stochastic Oscillator, are also pointing upwards, supporting the bullish sentiment surrounding Ethereum.

Moreover, Ethereum’s price has formed a bullish flag pattern, characterized by a vertical price movement followed by a consolidation phase that creates a rectangular channel. By measuring the vertical line of the flag, analysts project a potential price target of around $4,287, significantly higher than the current trading levels, adding to the excitement surrounding ETH’s prospects.

Bullish Catalysts: What’s Fueling Ethereum’s Rise?

Several pivotal catalysts appear to be propelling Ethereum’s ascent in July, making it a focal point for traders and investors alike. Firstly, new data indicates that demand for Ethereum Exchange-Traded Funds (ETFs) is on the rise. These funds have witnessed inflows totaling $4.5 billion in the last ten days alone, a strong signal of institutional interest and market confidence.

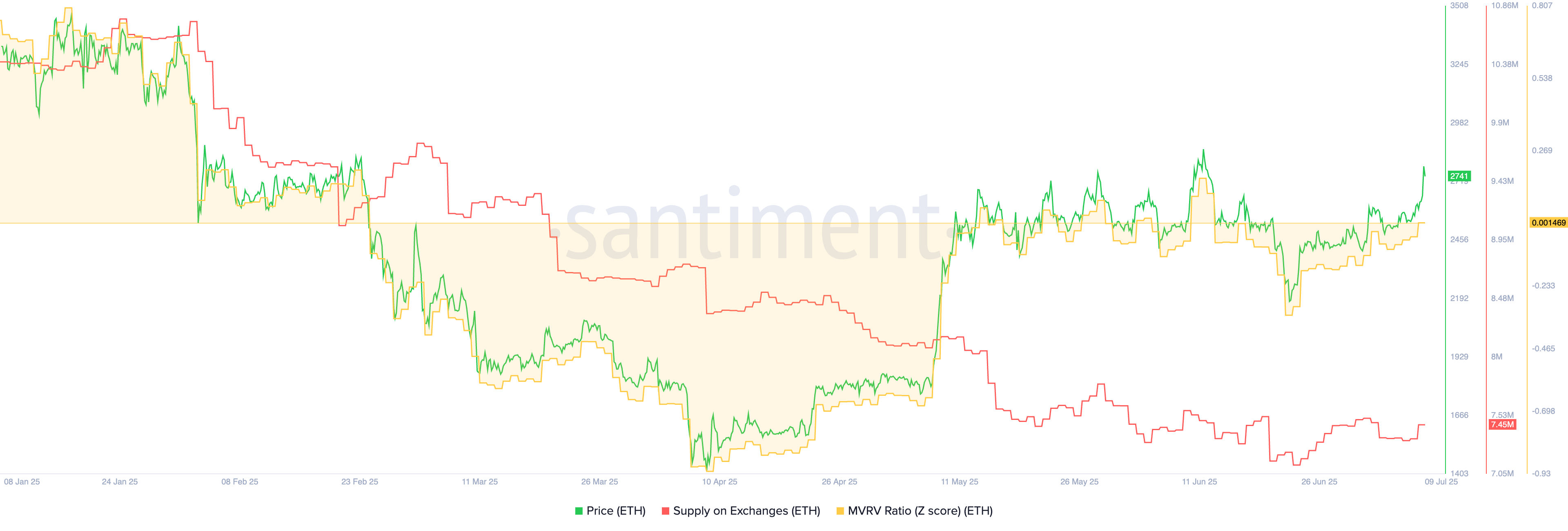

Secondly, we are seeing significant shifts in Ethereum’s supply dynamics. Recent reports highlight a dramatic decrease in the number of ETH coins available on exchanges, plummeting to approximately 7.45 million from a year-to-date high exceeding 10.5 million. This decline often suggests that investors are opting to hold onto their assets rather than selling—an encouraging sign for price stability and potential upward movement.

Despite Ethereum’s substantial recent price increase, many analysts suggest it remains relatively reasonably priced. The market value to realized value (MVRV) ratio has shown an uptick to 0.0014 from last month’s low of -0.34, yet it remains significantly beneath its historical highs. This suggests that Ethereum could still be an attractive investment opportunity for those keen on capitalizing on future market movements.

Additionally, the total value locked (TVL) in Ethereum has ascended by 6.5% over the past month, now surpassing $146 billion. The volume of bridged assets has also skyrocketed to over $403 billion, reflecting robust activity and interest in Ethereum’s ecosystem, a trend expected to persist in the coming months.

Furthermore, the stablecoin supply residing on exchanges has reached an all-time high of $126 billion, up from earlier lows, indicating increased liquidity and potential buying pressure within the market. This upward movement adds another layer of strength to Ethereum’s recovery, suggesting that despite lingering concerns, the platform is performing exceptionally well.

Overall, as the market continues to shift and evolve, Ethereum stands at the forefront, equipped with a variety of bullish indicators and catalysts that indicate a strong potential for growth. Investors and traders alike are undoubtedly keeping a keen eye on Ethereum as it navigates these dynamic market conditions.

READ MORE: Polygon Price Rare Pattern Signals a Rally as Ecosystem Rebounds