STBL, the token backing the RWA stablecoin protocol, has experienced a remarkable price surge of over 30% in just one day. This sharp increase comes in the wake of founder Avtar Sehra’s announcement on X regarding a buyback program set to launch in the fourth quarter, igniting optimism among investors.

This recent update has certainly contributed to STBL’s impressive double-digit gains. However, a closer look at technical indicators reveals potential challenges that could restrict further upside momentum.

Founder Confirms Q4 Buybacks in September

Sponsored

In his announcement, Sehra affirmed that the buyback initiative is a critical step toward establishing STBL as a public utility for programmatic capital. He envisions a protocol-driven treasury buyback strategy, where 100% of minting fees will be funneled into token repurchases. This approach is designed to bolster the overall value of STBL, increasing investor confidence.

STBL Surges 30%, But Divergence Signals Caution

Despite the impressive price increase, indicators such as the Chaikin Money Flow (CMF)—an essential metric for tracking capital inflows and outflows—paint a more cautious picture. As it currently stands, STBL’s CMF is below the zero line and showing a declining trend.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

The CMF is instrumental in determining the balance of buying versus selling pressure. A reading above zero indicates that buying activity is outpacing selling, signaling robust momentum. Conversely, a negative reading indicates prevailing selling pressure. The current downward trend in the CMF, against the rising price of STBL, suggests a bearish divergence, indicating that the current rally might not be fully supported by increasing demand.

This bearish divergence raises concerns that, despite the token’s double-digit gains, the underlying buying pressure is weakening. Such trends are often precursors to price corrections or consolidations, hinting at a possible pullback in STBL’s value soon.

Sponsored

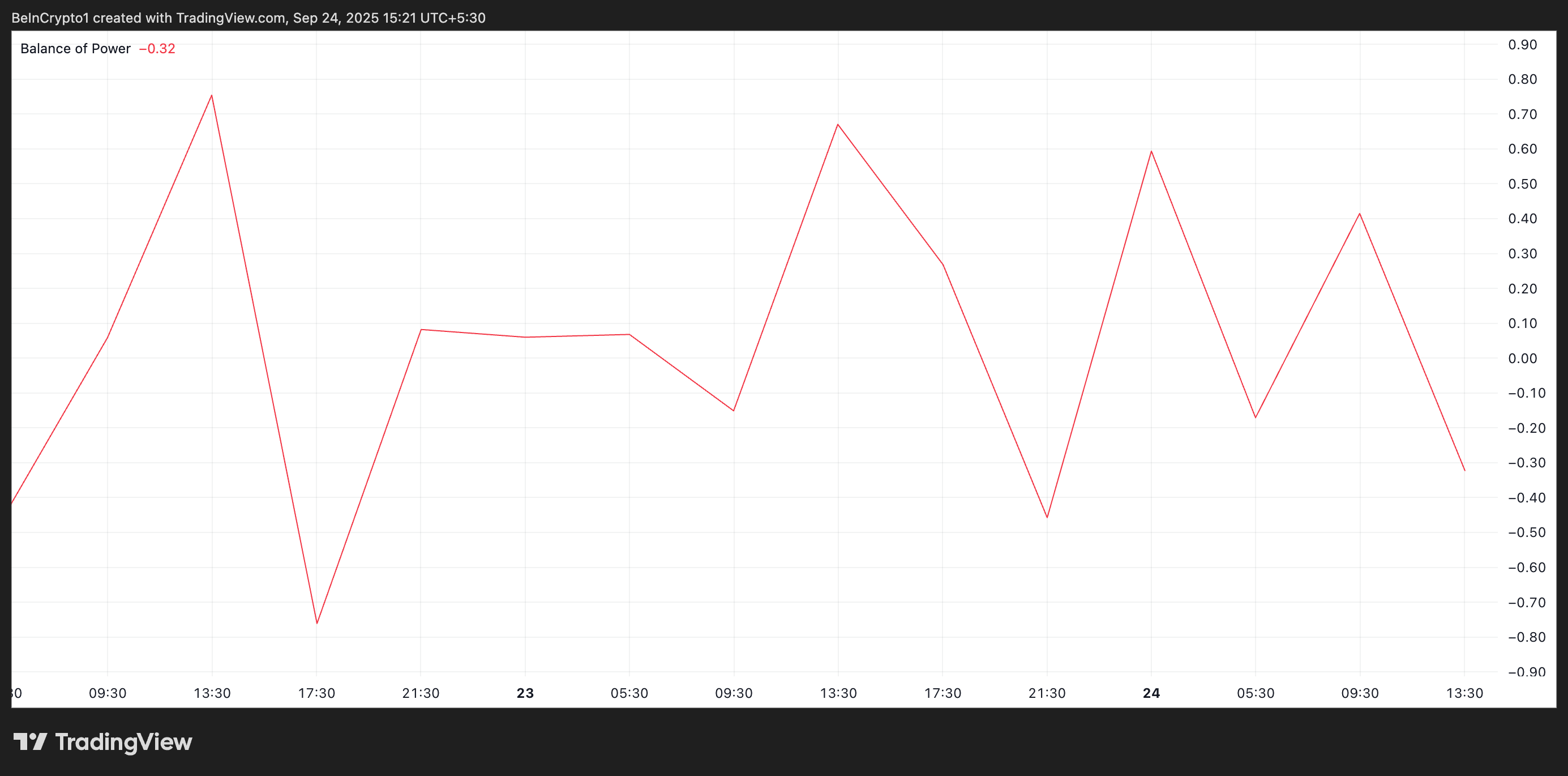

Further complicating the picture is a negative Balance of Power (BoP), which currently sits at -0.32. The BoP is another crucial momentum indicator that measures the strength of buyers against sellers. Positive values imply that buyers are in command, propelling prices higher, while negative values indicate seller dominance.

A negative BoP during an upward price trend is particularly alarming, as it signals lurking selling pressure that could disrupt the rally even as the token’s value appears to rise.

STBL’s Rally on the Edge

All these signals imply that the current rally of STBL may be more a product of speculative activity than genuine demand. This raises red flags for the sustainability of recent gains.

If selling pressure escalates, STBL’s upward trajectory could reverse and potentially revisit support levels around $0.36.

Conversely, should buyers regain confidence and momentum, they could propel STBL’s price upward, possibly reaching $0.53.