Wintermute Report: Crypto Market Underperforms Despite Fed Rate Cuts

Why is crypto struggling while other markets are doing so well? Wintermute’s recent report indicates that despite the growing global liquidity and central banks cutting interest rates, the crypto market is failing to keep pace with stocks, AI, and prediction markets.

As of now, the crypto market cap stands at a staggering $3.39 trillion, having experienced a decrease of 2.4% in just the last 24 hours.

Source: CMC

Money Is Flowing Just Not Into Crypto

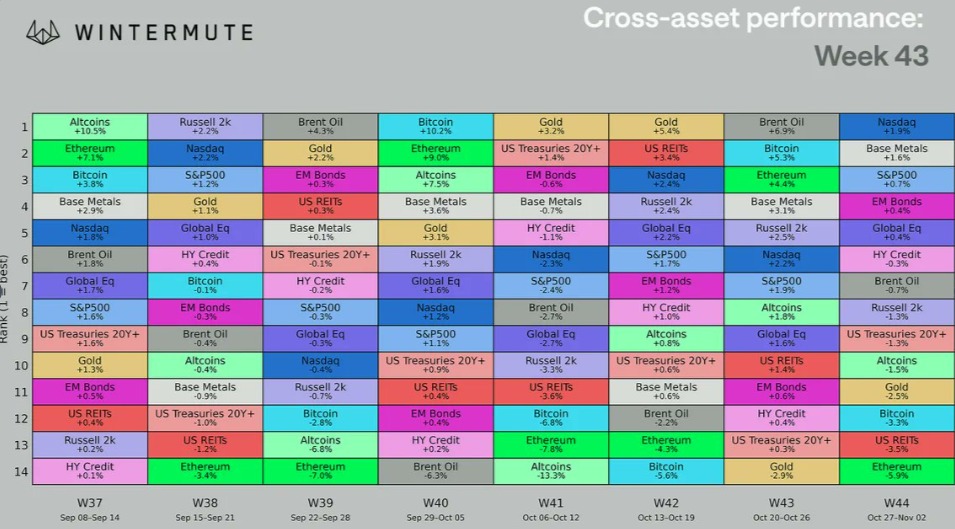

Wintermute’s Week 43 report highlights that while money is circulating throughout global markets, a noticeably smaller fraction is being invested in digital assets.

-

Bitcoin experienced a surge of about +10% in late September, but has since dropped nearly -6% by early November.

-

Ethereum recorded a strong +9% gain in Week 39, but later fell by approximately -5.9%.

-

In contrast, the Nasdaq and Russell 2000 managed to secure slight increases, each up around +2%.

Source: Wintermute Report

This trend indicates that while liquidity remains robust in the financial ecosystem, investors are currently favoring traditional assets over digital currencies.

ETFs and DATs Cool Off While Stablecoins Keep Growing

The Wintermute report points out that three primary sources for inflows – ETFs, stablecoins, and DATs (Decentralized Autonomous Tokens) – have lost their balance.

Stablecoins, however, have continued their upward trajectory, increasing by over 50% this year and introducing roughly $100 billion in new supply.

In contrast, inflows into ETFs have sharply declined, with Bitcoin ETF holdings stagnating near $150 billion. Moreover, trading activity related to DATs on major exchanges like Nasdaq has also seen a significant downturn, suggesting that liquidity exists but is not being funneled into the crypto sector as prominently as before.

Supportive Economy, Weak Crypto Sentiment

Despite a generally positive economic environment, the crypto sentiment appears woefully inadequate. Recently, the U.S. Federal Reserve cut interest rates by 25 basis points and ended quantitative tightening efforts—actions historically favorable for risk assets, including cryptocurrencies. However, Fed Chair Jerome Powell’s indications that further rate cuts might not occur in December have led traders to retreat, applying downward pressure on riskier markets.

During this period, gaming tokens faced a steep decline of -21%, Layer-2 networks saw a drop of -19%, and meme coins slid by -18%. The only exceptions were AI and DePIN tokens, which showcased slightly better resilience in the face of market pressures.

Bitcoin Price Prediction: Waiting for Fresh Inflows

Bitcoin is currently trading at $102,106, reflecting a 2.5% drop over 24 hours. Analysts predict that short-term support is positioned around $98,000, with resistance near $105,000. If a dip occurs below $98K, it might trigger further corrections approaching $94,000, revealing a cautious sentiment amid weak ETF inflows and uncertain macroeconomic conditions.

What Lies Ahead for Crypto

The main takeaway from Wintermute’s report is quite revealing: the underperformance of the crypto market is not due to weak fundamentals but rather because liquidity is directing elsewhere. The traditional “four-year crypto cycle,” often predicated on halving events, seems less influential today. The driving factors of prices now hinge more on money flow, and until fresh capital re-enters through ETFs or DATs, the industry may lag behind traditional markets, even in favorable economic scenarios.