In the dynamic world of cryptocurrency, a pulse of renewed activity has emerged, shaking off a prolonged period of consolidation. This week, the global crypto market capitalization has climbed by 2%, signaling a resurgence of interest and investment.

This revitalized momentum has caught the attention of large, institutional investors—often referred to as whales—who are strategically accumulating certain altcoins. Among the assets experiencing a spike in interest are Ripple (XRP), Litecoin (LTC), and Toncoin (TON).

Ripple (XRP)

Ripple’s XRP has taken the spotlight this week, experiencing a significant increase in whale activity. Data from Santiment indicates that investors holding between 1,000,000 and 10,000,000 XRP tokens have acquired a staggering 180 million tokens over the past seven days. This accumulation equates to over $590 million at current market prices, reflecting a strong boost in investor confidence.

This uptick in whale accumulation coincides with positive developments around XRP in the political landscape. Reports suggest that President-elect Donald Trump is considering establishing an “America-first strategic reserve” that may include XRP and other cryptocurrencies. This potential endorsement from a high-profile political figure only strengthens the case for XRP in investors’ eyes.

Despite ongoing legal challenges and the US Securities and Exchange Commission’s (SEC) formal appeal against Ripple Labs, the enthusiasm for XRP remains undeterred. Notably, XRP recently reached an all-time high in value, showcasing the resilience and optimism within the XRP community.

Litecoin (LTC)

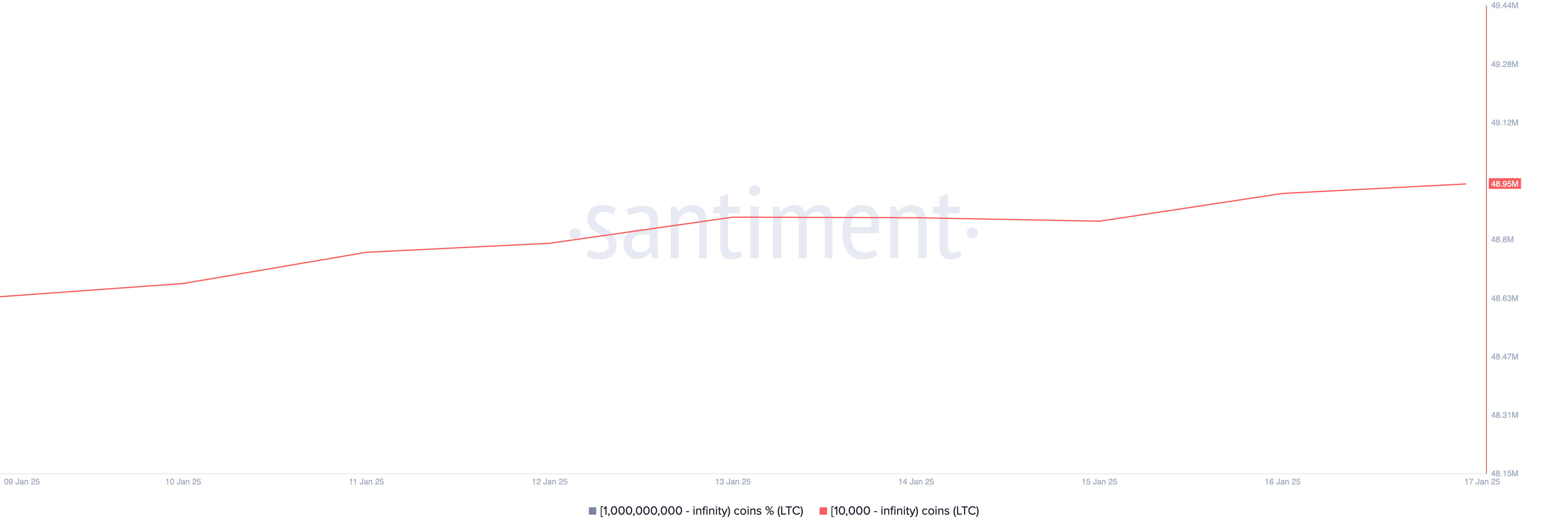

Litecoin (LTC) is another cryptocurrency experiencing a surge in whale activity, making it a hot topic among investors this week. Over the past seven days, large holders of LTC, defined as those holding more than 10,000 coins, have accumulated an impressive 300,000 LTC, amounting to over $41 million.

This investment surge is driven by positive sentiment surrounding the potential approval of a spot Litecoin exchange-traded fund (ETF) in the United States. Canary Capital’s recent amendment to its S-1 registration form with the SEC suggests that significant progress is being made toward ETF approval, much to the delight of LTC holders. If this trend continues, analysts predict that LTC’s price could rise toward $147.

Toncoin (TON)

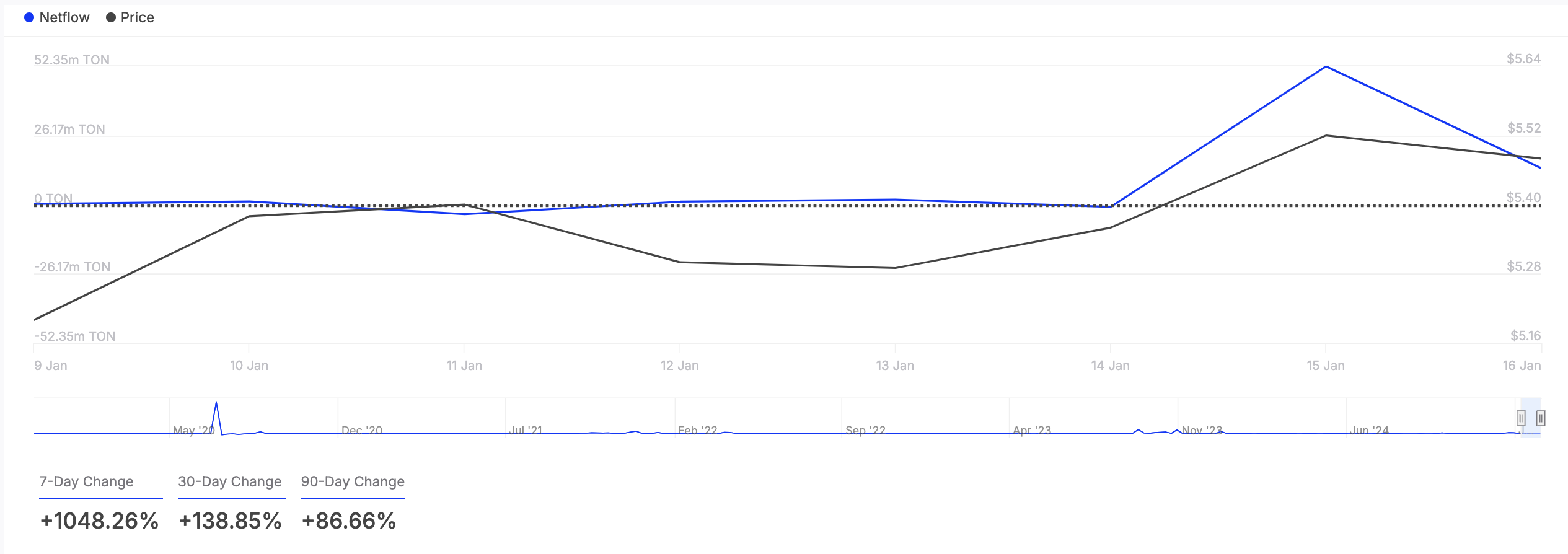

In the current wave of whale accumulation, Toncoin (TON), which is closely linked to Telegram, has emerged as a preferred asset. This week, the cryptocurrency has seen a remarkable increase of 1048% in netflow among large holders—those possessing more than 0.1% of the total circulating supply. Such a surge indicates that these investors are buying up significantly more Toncoin than they are selling, a promising sign for the digital asset.

If the enthusiasm among TON whales maintains its current trajectory, predictions indicate that the price of Toncoin may climb toward $6.