Lido DAO (LDO): A Bullish Price Action Amid Market Recovery

As the cryptocurrency market gradually finds its footing in the wake of recent volatility, Lido DAO (LDO) is emerging as a standout performer, capturing the attention of traders and enthusiasts alike. For weeks, LDO has maneuvered within a narrow price range, fluctuating between $1.50 and $2.00, yet recent price movements suggest that it may be on the brink of a breakout.

Lido DAO (LDO) Technical Analysis

Since late December 2024, LDO has been trading within a tight range, where the $2 level has proven to be a formidable resistance. Multiple attempts to breach this line have resulted in significant pullbacks, indicating the strength of selling pressure at this threshold. However, shifting market sentiment may provide the momentum needed for LDO to finally break free from this restrictive pattern.

Traders and analysts are closely monitoring the situation, as a decisive breakout could signal a new bullish trend for LDO. The technical landscape shows that achieving a daily close above the $2.15 mark will be crucial for validating any bullish sentiment. Without this confirmation, any price movement beyond $2 could lead to a potential fakeout, leaving traders exposed.

Source: Trading View

LDO Price Prediction

When analyzing potential price movements for LDO, the indications from both recent developments and historical patterns suggest promising possibilities. Should LDO maintain its upward momentum and successfully close the daily candle above $2.15, the outlook turns decidedly bullish. Analysts forecast that, in such a scenario, LDO could surge by as much as 55%, targeting the $3.37 price point in the weeks ahead.

Currently, LDO is trading above its 200 Exponential Moving Average (EMA) on the daily chart, which often signals an overall uptrend. Notably, the Relative Strength Index (RSI) sits below 55, implying that LDO retains considerable room for upward movement. This combination of technical signals offers a healthy backdrop for potential price increases.

Bullish On-Chain Metrics

In addition to positive technical indicators, on-chain metrics provide further backing to the bullish narrative surrounding LDO. Recent data from Coinglass highlights a surge in LDO’s open interest, with a remarkable 32% increase observed within a 24-hour window and a 20% surge over the past four hours. This uptick reflects heightened engagement from traders, particularly within intraday movements.

Source: Coinglass

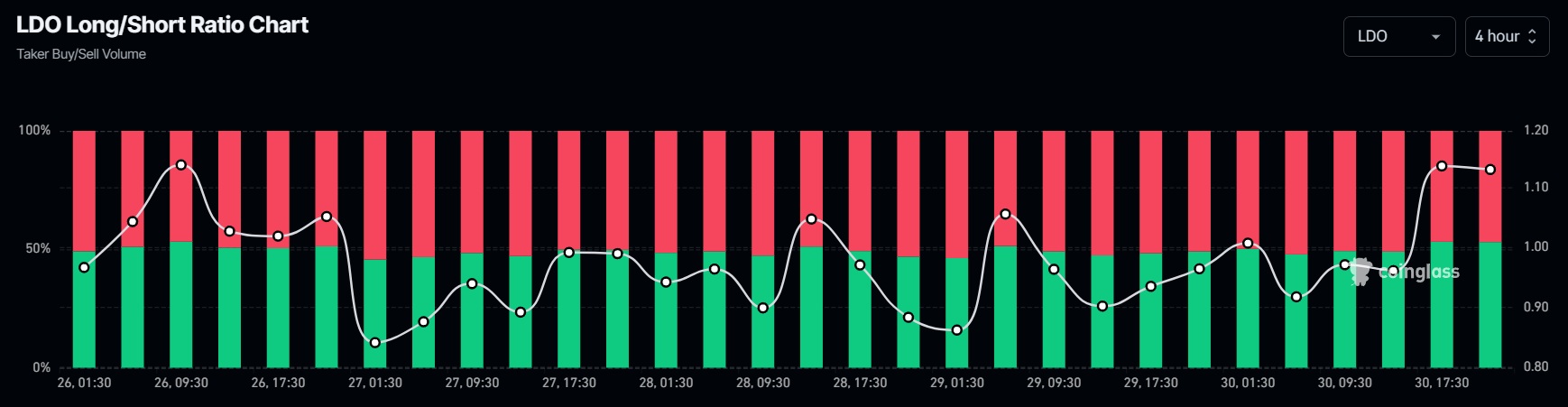

Moreover, a glance at the LDO long/short ratio reveals that traders are favoring long positions significantly. Currently, the ratio stands at 1.14, with over 53.50% of traders opting for long positions compared to 46.50% short positions. This bullish sentiment is indicative of a confidence boost among investors, potentially paving the way for more upward price action.

Current Price Momentum

At present, LDO is trading near $2.13, showcasing a remarkable 16% increase in the last 24 hours alone. This sharp rise comes hand-in-hand with a substantial 60% uptick in trading volume during the same period, further demonstrating enhanced participation from both traders and investors. The current momentum signals a favorable environment for continued engagement with the LDO asset.

While the landscape remains dynamic, Lido DAO stands at a pivotal crossroads, with its next movements closely tied to both external market conditions and internal technical factors. Traders will be keeping a watchful eye on this asset as it navigates potential resistance and seeks to establish a new bullish phase.