Bitcoin, Ethereum, and Altcoins: Are They Setting a Bull Trap?

In the ever-evolving world of cryptocurrency, predictions about market movements are as frequent as they are varied. Recently, a widely followed cryptocurrency analyst known as Capo ignited conversations across social media platforms about the potential for Bitcoin (BTC), Ethereum (ETH), and various altcoins to be forming what is known as a "bull trap." Based on his analysis shared on X (formerly Twitter), Capo suggests that while a short-term rise in cryptocurrency prices may be imminent, it could be followed by an unexpected downturn.

Understanding the Bull Trap Phenomenon

A bull trap occurs when asset prices appear to be on an uptrend, luring investors into buying, only to reverse direction and lead to significant losses for those who bought into the hype. Capo cautions followers that this scenario might soon play out in the cryptocurrency market, which can be notoriously volatile.

Predictions for Bitcoin and Ethereum

Capo’s bullish outlook is striking. He foresees Bitcoin potentially skyrocketing to $100,000, while Ethereum might touch $3,000. He suggests that numerous altcoins could benefit from this surge, with predicted gains of 10% to 50% from their current price levels. However, this bullish momentum might not last, leading to a significant pullback shortly after.

BTCUSD 1-Day price chart. Source: X

The Potential Market Correction

After the anticipated surge, Capo warns that there could be a sharp correction in the crypto market, with Bitcoin, Ethereum, and other cryptocurrencies experiencing price drops ranging from 30% to 60%. This prediction raises eyebrows, particularly as it suggests that traders should brace themselves for heightened volatility in the coming weeks or months. Market corrections can oftentimes stem from major events that disrupt the financial landscape, commonly referred to as "black swan" events—those rare and unpredictable occurrences with significant impact.

Black Swan Events: A Historical Perspective

A notable example of a black swan event is the COVID-19 pandemic, which led to dramatic market declines globally. Capo argues that the cryptocurrency market could be due for a similar shakeout, potentially exacerbated by overarching economic conditions or geopolitical turmoil.

While he remains optimistic about Bitcoin’s long-term potential—predicting it could bounce back to around $116,000 after a dip to $69,000—investors are left to navigate the uncertainty of short-term fluctuations amidst a potentially turbulent market environment.

Prospects for Altcoins

Capo is not alone in his observations. Analyst Crypto Rover recently echoed similar sentiments, claiming that altcoins are currently in an oversold condition. This could present a lucrative buying opportunity for traders who have a strong appetite for risk, especially as they await what is referred to as "altseason," a period when altcoins typically see significant price increases. As of now, Ethereum is trading at $2,010, having witnessed an 8% decline in the last 24 hours.

“Altcoins are oversold. Altcoin season hasn’t even started yet.” – Crypto Rover

Bitcoin’s Recent Performance

Bitcoin’s trajectory has been equally complex. Following a recent downturn that saw its value drop to $84,000, investors are anxious about the current market conditions. Despite positive developments such as an executive order aiming to create a strategic Bitcoin reserve, this has not translated into price increases. As it stands, Bitcoin is trading at $82,659, reflecting a 4% decline in just one day.

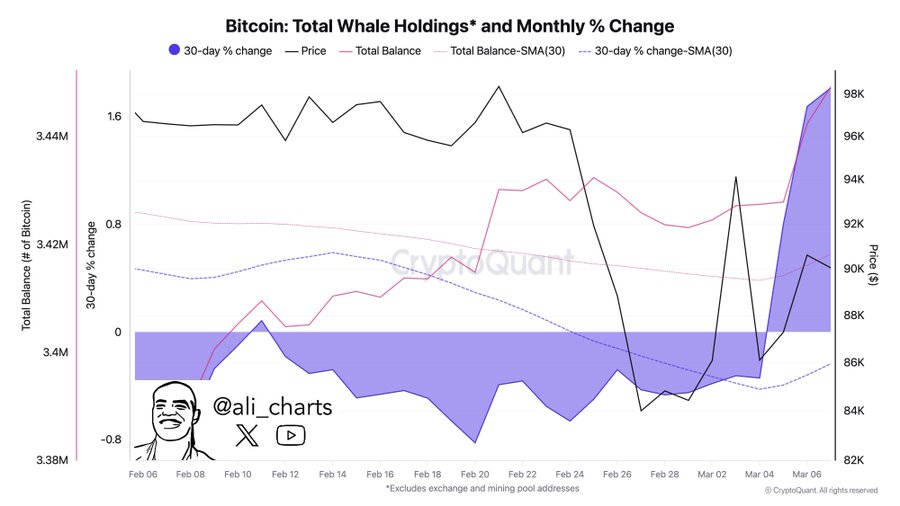

Recent on-chain data indicates an 11% decrease in Bitcoin’s value over the past week, accompanied by a significant 53% drop in daily trading volumes. Contrarily, there are signs of optimism as Bitcoin whales have purchased over 22,000 BTC in three consecutive days, illustrating the ongoing bullish sentiment among institutional investors.

Source: X

The Road Ahead

The road ahead for Bitcoin and the broader cryptocurrency market is laden with uncertainty. Analysts caution that while the potential for gains exists, the lurking threat of a bull trap could catch many unaware. Investors would do well to stay informed, reevaluate their strategies, and keep a close watch on market signals that may indicate upcoming corrections—a hallmark of the high-stakes world of cryptocurrency trading.

As the landscape continues to shift, discerning the patterns and movements within this dynamic environment will be essential for those looking to navigate the exhilarating yet unpredictable world of digital assets.