The FOMC concluded its latest meeting by announcing that it will not cut US interest rates. This decision was largely priced in, and the crypto market hasn’t seriously suffered.

Rate cuts would’ve provided a bullish narrative to juice fresh investment, which the market desperately needs. Bearish signals are growing alongside fears of a US recession.

Federal Reserve Says No to Rate Cuts

The Federal Reserve’s Federal Open Market Committee (FOMC) recently concluded a highly anticipated meeting that influences much of US financial policy. The crypto industry had been closely monitoring the FOMC’s decisions, particularly regarding the potential for interest rate cuts. In a clear message to the public, the FOMC announced that no cuts would take place.

The FOMC’s official report reassured markets that they would maintain the target range for the federal funds rate at 4.25% to 4.5%. This was a decision that mirrored the expectations of many industry insiders, as Fed Chair Jerome Powell had previously indicated that cuts were off the table for now.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty around the economic outlook has increased. The Committee is attentive to the risks to both sides of its dual mandate. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4.25% to 4.5%,” it said.

The decision not to cut rates means that the crypto market will need to look for encouragement from other sources. Investors had hoped that lower interest rates could instill a bullish momentum, especially given the currently shaky market sentiments. Unfortunately, assurances from the Fed that it would not implement cuts mean that any potential enthusiasm must now be sought elsewhere.

Despite the pessimistic news concerning rate cuts, the FOMC did express some level of optimism by signaling its intentions to lower interest rates by half a percentage point by 2025. This projection suggests the possibility of two cuts later this year, albeit modest ones, that may help nudge investors back toward a more risk-on stance as we approach 2025.

Investors, particularly those focused on cryptoassets, had been keenly awaiting any signs of rate cuts that could lead to enhanced liquidity and investment opportunities. However, the FOMC’s dual mandate — which encompasses balancing inflation concerns with job growth — remains a significant influence on its decisions. The uncertainty surrounding the US economy, further complicated by external factors like tariffs and potential economic downturns, meant that the Fed chose to prioritize stability over immediate market enthusiasm.

It’s essential to understand that cutting interest rates could lead to an uptick in inflation, something the FOMC is keen to avoid. The latest Consumer Price Index (CPI) report had provided some hope, suggesting that inflation rates were trending better than anticipated, yet this has not been enough to sway FOMC’s cautious approach. Influential figures, including former President Trump, have advocated for rate cuts, yet these calls have not seen substantial backing from the Federal Reserve.

On a slightly more positive note, the FOMC did announce plans to slow down its Quantitative Tightening (QT) strategy. By reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion, the Fed is likely hoping to increase market liquidity, offering a small yet significant boost for investors who view this as a potential lifeline.

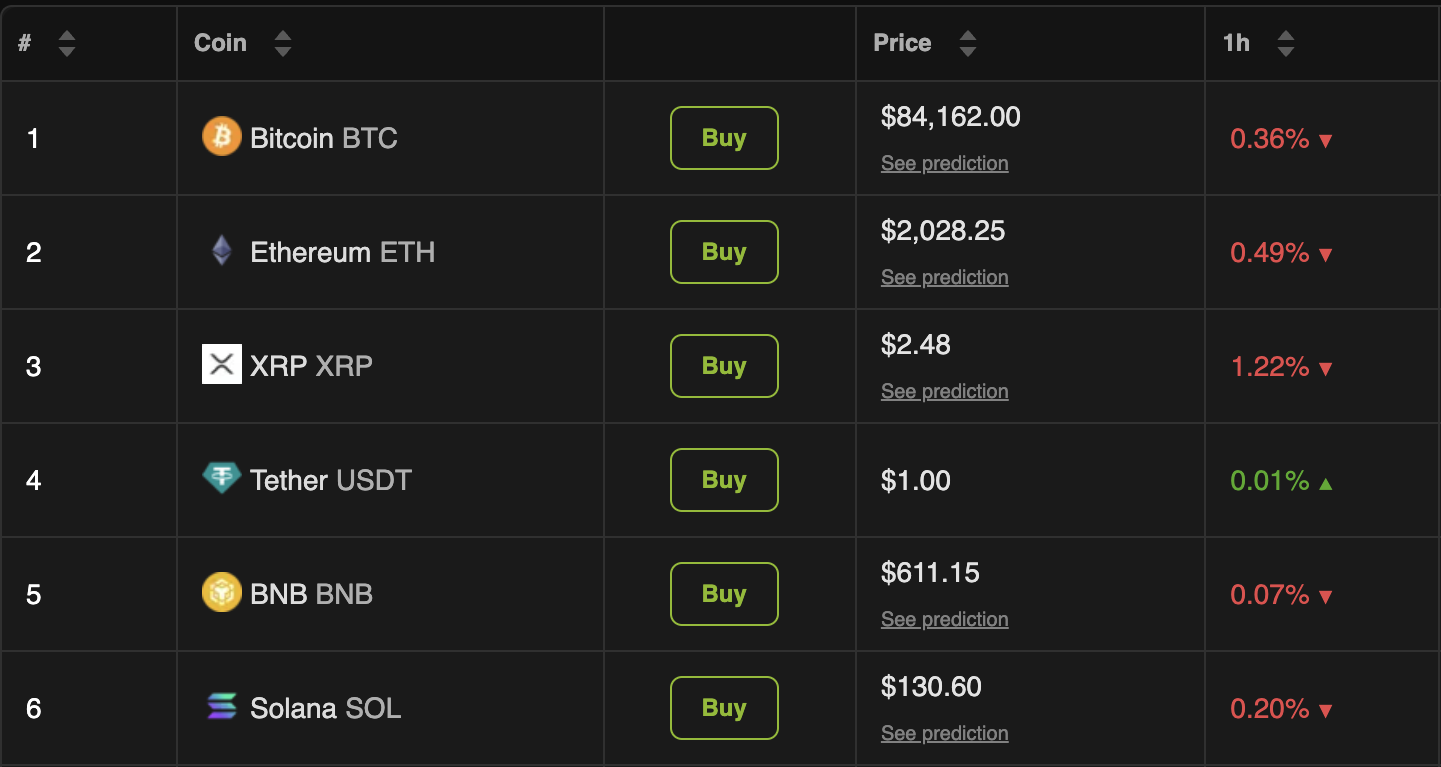

The market’s reaction to the FOMC’s announcement has remained relatively stable. Although some of the top-performing crypto assets experienced minor losses, the overall volatility that some had feared did not materialize. This reflects how much of the news was anticipated and factored into current market prices, with investors having already adjusted their strategies in light of the Fed’s stance.

The current environment leaves the crypto industry in a precarious position. With a palpable yearning for bullish momentum, many players find themselves amidst a broader market uncertainty. While the FOMC’s decision not to cut rates aligns with market expectations, it does not alleviate the underlying concerns that could lead to a larger market correction should new growth narratives remain elusive.