### Bitcoin’s Breakout: Price Dynamics and Market Sentiment

Bitcoin has been making headlines lately, breaking above its 200-day Exponential Moving Average (EMA) at $85,000 early last week. This surge marked an impressive rally of 11.14% leading up to Friday. However, despite this upward momentum, BTC struggled to close above its March high of $95,000. For the past few days, it has been hovering around this pivotal level, signaling a period of stabilization that traders are keenly observing.

### The Challenge Ahead for Bitcoin

Hovering around the $95,000 mark, Bitcoin faces a significant barrier. The inability to surpass the March high raises questions about market sentiment and the potential for fresh buying momentum. Investors are understandably anxious; a strong push above this resistance could open up new price targets, while continued indecision might lead to fluctuations or a pullback. The significance of technical indicators, such as the EMA, cannot be overlooked as they help map out potential future price trajectories.

### TRON’s Uncertain Future: Support Levels Tested

Shifting gears to TRON, we observe a contrasting narrative. The price outlook appears precarious as it teeters on the brink, with immediate support at the 50-day EMA near $0.24 showing signs of weakness. The upper cap seems to be firmly placed under $0.25, creating a red-shaded area of resistance on the daily chart. This critical juncture has many traders on edge, particularly since the Relative Strength Index (RSI) is retracing from recent highs of 66.77, approaching the midline of 50. This trend indicates a potential increase in sell-side pressure, which could jeopardize a bullish recovery.

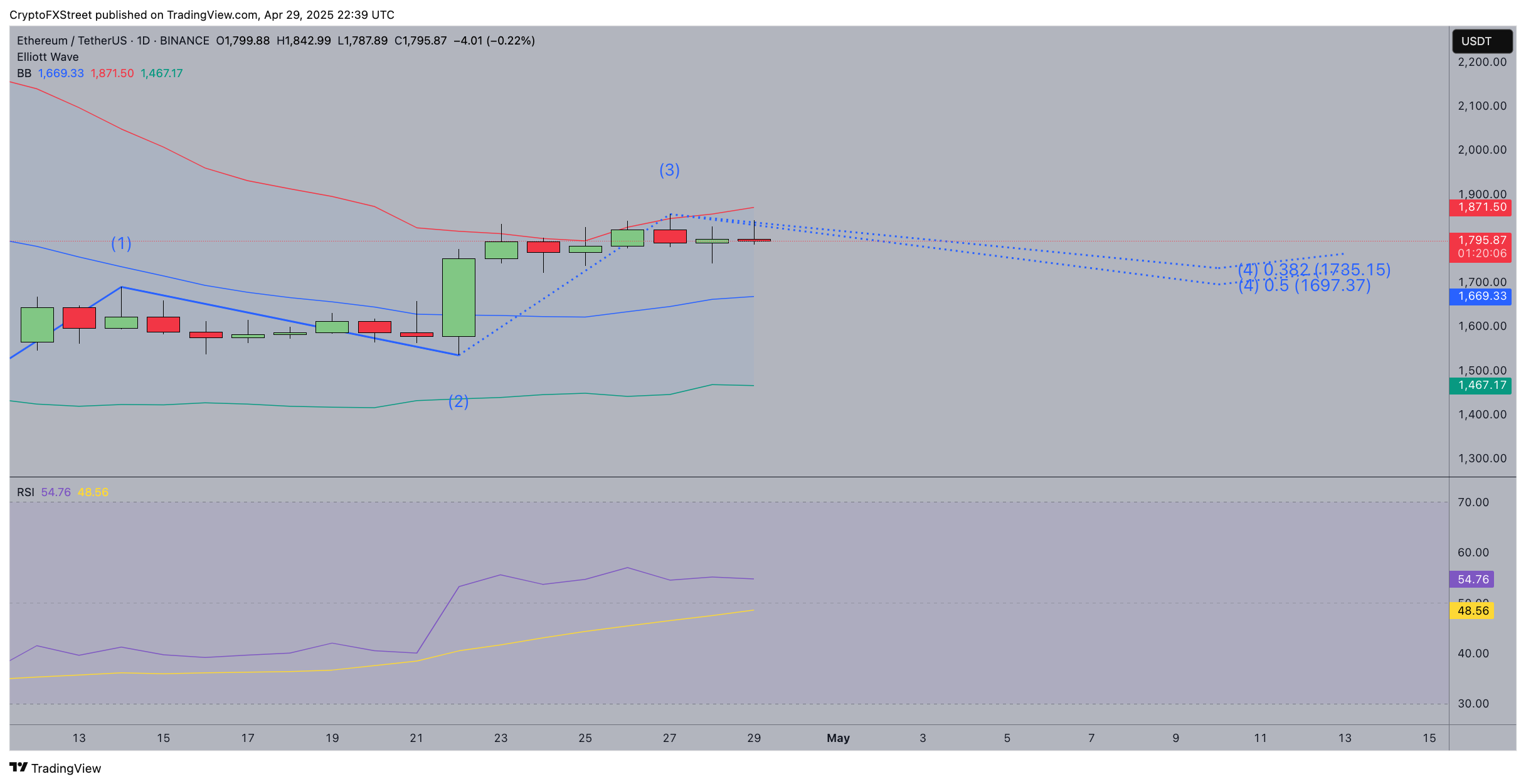

### Ethereum: Outperforming Bitcoin in Recent Days

Meanwhile, Ethereum is painting a more optimistic picture. On Tuesday, ETH recorded a 2% rally, reaching a new monthly peak of $1,837. This performance suggests that Ethereum is poised to outperform Bitcoin in the short term. Observations from the derivatives markets show that this upswing coincides with a significant volume of traders closing their short positions. A question on the minds of many investors is whether BlackRock’s recent record-breaking Bitcoin acquisition could serve as a catalyst for an ETH breakout towards the psychological level of $2,000.

### Market Trends and Investor Sentiment

The overall cryptocurrency market is in a dynamic state. Bitcoin’s recent challenges, TRON’s uncertain outlook, and Ethereum’s impressive performance reflect the diverse landscape of digital assets. Market sentiment is heavily influenced by external factors, such as institutional investments and regulatory developments. As traders analyze these trends, the interplay between bullish and bearish forces will shape the future direction of these cryptocurrencies.

Through the lens of technical analysis, trends like EMAs and RSI levels allow traders to gauge potential movements. Keeping an eye on these indicators could provide valuable insights into the market’s next moves, making this an exciting time for those invested in the cryptocurrency space.