Ethereum (ETH) has once again captured the spotlight in the cryptocurrency market, standing proudly as the second-largest cryptocurrency by market capitalization. Recent developments point to a potential upside rally, particularly following the formation of bullish price action on the daily timeframe. While the cryptocurrency market as a whole recently faced a decline, the current signs indicate that sentiment is shifting from a downtrend to a much-anticipated uptrend.

Ethereum (ETH) Technical Analysis and Upcoming Levels

Technical analysis of Ethereum’s price movements reveals that ETH has successfully broken out of a bullish falling wedge pattern that has been forming since November 2024. This breakout signifies a major shift in market sentiment, suggesting increased investor confidence. With the acknowledgment of the pattern, traders are keeping an eye on key price levels that could dictate Ethereum’s future trajectory.

According to historical price momentum, a successful close above the $3,400 level might set the stage for Ethereum to surge by approximately 20%, potentially reaching the coveted $4,100 mark. As it stands, ETH is contending with resistance around the $3,400 level, a pivotal point for its future gain prospects.

Encouragingly, the Relative Strength Index (RSI) has settled at 55, a figure indicating sufficient strength to sustain ETH’s upside momentum. This momentum could be the much-needed catalyst for Ethereum as it attempts to overcome resistance levels.

On-Chain Metrics and Mixed Sentiment

Despite the positive technical indicators, a closer look at on-chain metrics presents a mixed sentiment. On-chain analytics firm CoinGlass has reported that long-term holders and investors have recently been offloading their assets. The data reveals a substantial inflow of $103 million worth of Ethereum into exchanges, triggering concerns about possible sell-off pressures that could hinder price stability.

In the cryptocurrency universe, inflow trends are critical. An increasing inflow signals a potential sell-off, which can induce downward price pressure. However, it’s not all doom and gloom. Despite the liquidations affecting long-term holders, traders appear to be betting heavily on long positions, reflecting a predominantly bullish sentiment.

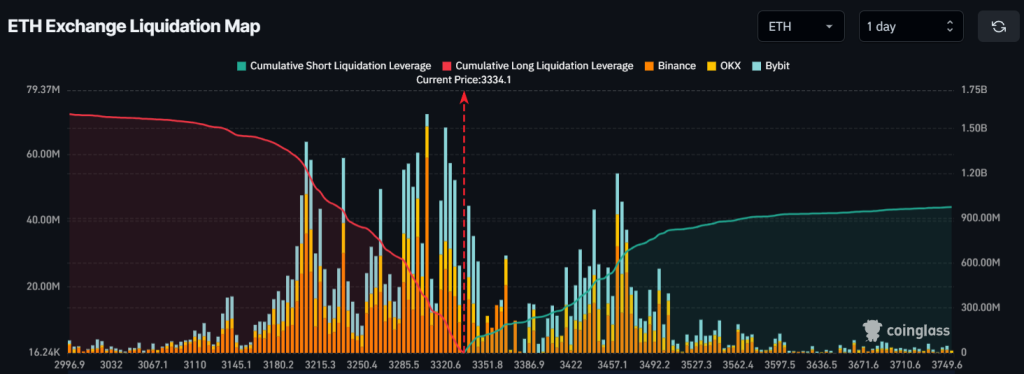

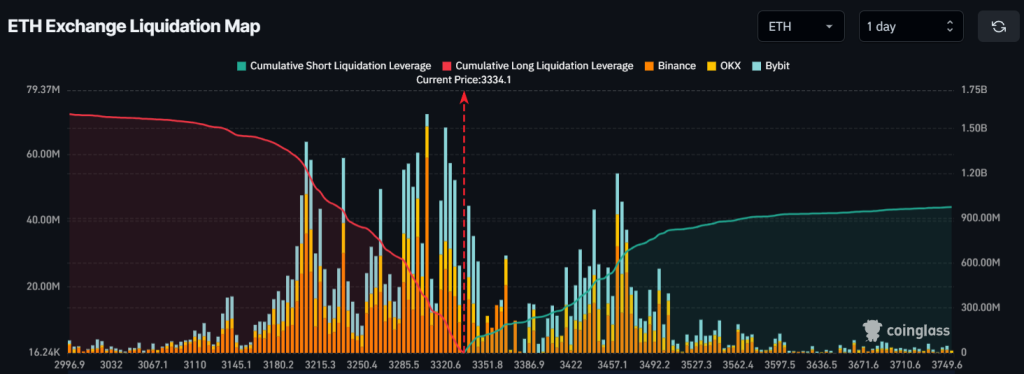

Presently, key liquidation levels are surfacing — $3,305 on the lower side indicates where bulls may be over-leveraged, holding approximately $360 million in long positions. Conversely, at $3,370, short sellers are reported to be over-leveraged, with their positions amounting to about $190 million.

These metrics suggest that bulls hold the upper hand in determining Ethereum’s immediate price action and might provide the necessary support for breaking through the critical resistance level of $3,400.

Current Price Momentum

At the time of this analysis, ETH is trading around $3,350, having seen a price increase of more than 1.50% in the last 24 hours. This price surge coincides with a 10% uptick in trading volume, reflecting greater engagement from both traders and investors, likely spurred on by the recent bullish breakout. Increased trading volume typically indicates heightened market activity, suggesting that participants are responding favorably to Ethereum’s recent performance and potential growth prospects.