Ethereum’s (ETH) dominance has steadily declined over the past two years. This suggests that investor capital is no longer prioritizing ETH. Instead, funds are likely shifting toward Bitcoin and other altcoins like Solana or XRP.

However, analysts see a major opportunity in this situation. Many believe there is now a rare chance to accumulate ETH.

Could Ethereum’s 5-Year Dominance Low be an Opportunity?

Ethereum’s dominance, referred to as ETH dominance (ETH.D), dropped significantly from 20% in June 2023 to approximately 7.3% in 2025, according to analyst Rekt Capital. This steep decline indicates that Ethereum’s market cap as a percentage of the total cryptocurrency market has waned, suggesting a diminishing interest among investors in favor of alternative cryptocurrencies.

When evaluating the ETH dominance metric, a downward trend is concerning for holders and potential investors. Nonetheless, Rekt Capital provided a silver lining by revealing a chart that indicates ETH.D touching a green support zone—a historical trend suggesting that Ethereum often reverses and regains market strength from this lower boundary.

Rekt Capital further pondered whether Ethereum could replicate its historical reversal patterns, suggesting that now may be a strong buy signal for savvy investors.

“Since June 2023, Ethereum Dominance has dropped from 20% to 8%. Historically, Ethereum Dominance has reversed from this green area to become more market-dominant. Can Ethereum repeat history?” Rekt Capital said.

Adding to this perspective, analyst CryptoAnup noted that dips in ETH dominance typically signal excellent opportunities for accumulation. He pointed out that historically speaking, record lows in ETH.D frequently herald a new growth cycle.

“ETH Dominance seems to have found a floor—rebound soon!” CryptoAnup predicted.

However, the picture is clouded by the recent activity of Ethereum whale addresses. As per a report from BeInCrypto, wallets that hold between 100,000 and 1 million ETH sold approximately 1.19 million ETH recently, equating to over $1.8 billion. Such sizable sell-offs are putting downward pressure on ETH’s price and overall dominance, further complicating the market landscape.

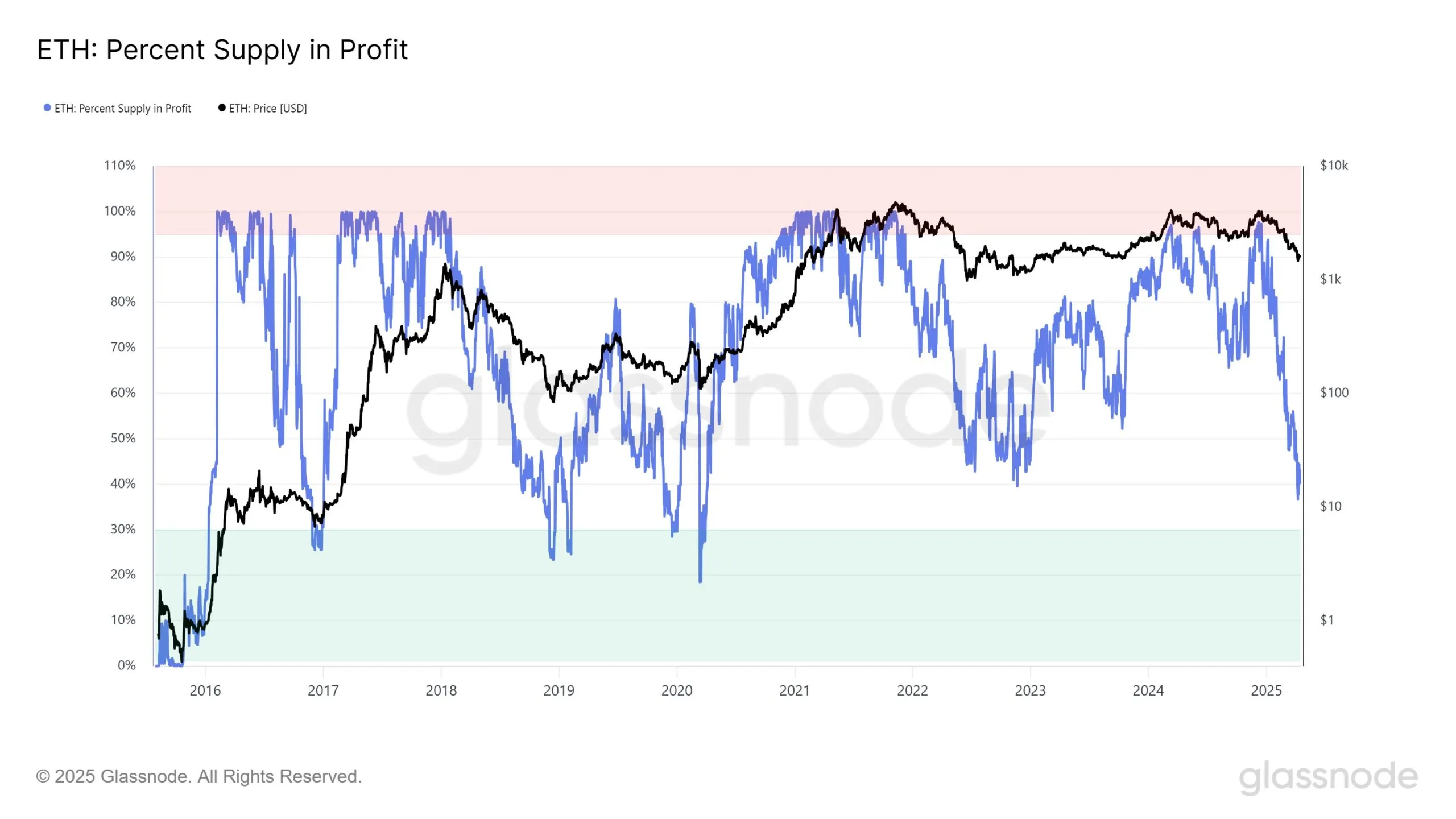

ETH Supply in Profit Drops to Lowest Level in 4 Years

Another alarming trend is the decline in the percentage of Ethereum’s supply that is currently in profit. Data from Glassnode indicates that this figure has hit a four-year low, with only 40% of the ETH supply remaining profitable—a stark decrease from 97.5% in early December 2024. This dramatic dip raises concerns among investors but also signals potential buying opportunities.

Analyst Venturefounder emphasized that if this metric falls below 30%, it historically indicates a rare accumulation opportunity, one that has occurred only a few times over the past decade.

“ETH percentage supply in profit (40%) now lower than the last bear market cycle bottom (42%) when ETH was trading at $800. Looking on-chain, this is already signal to deploy,” Venturefounder said.

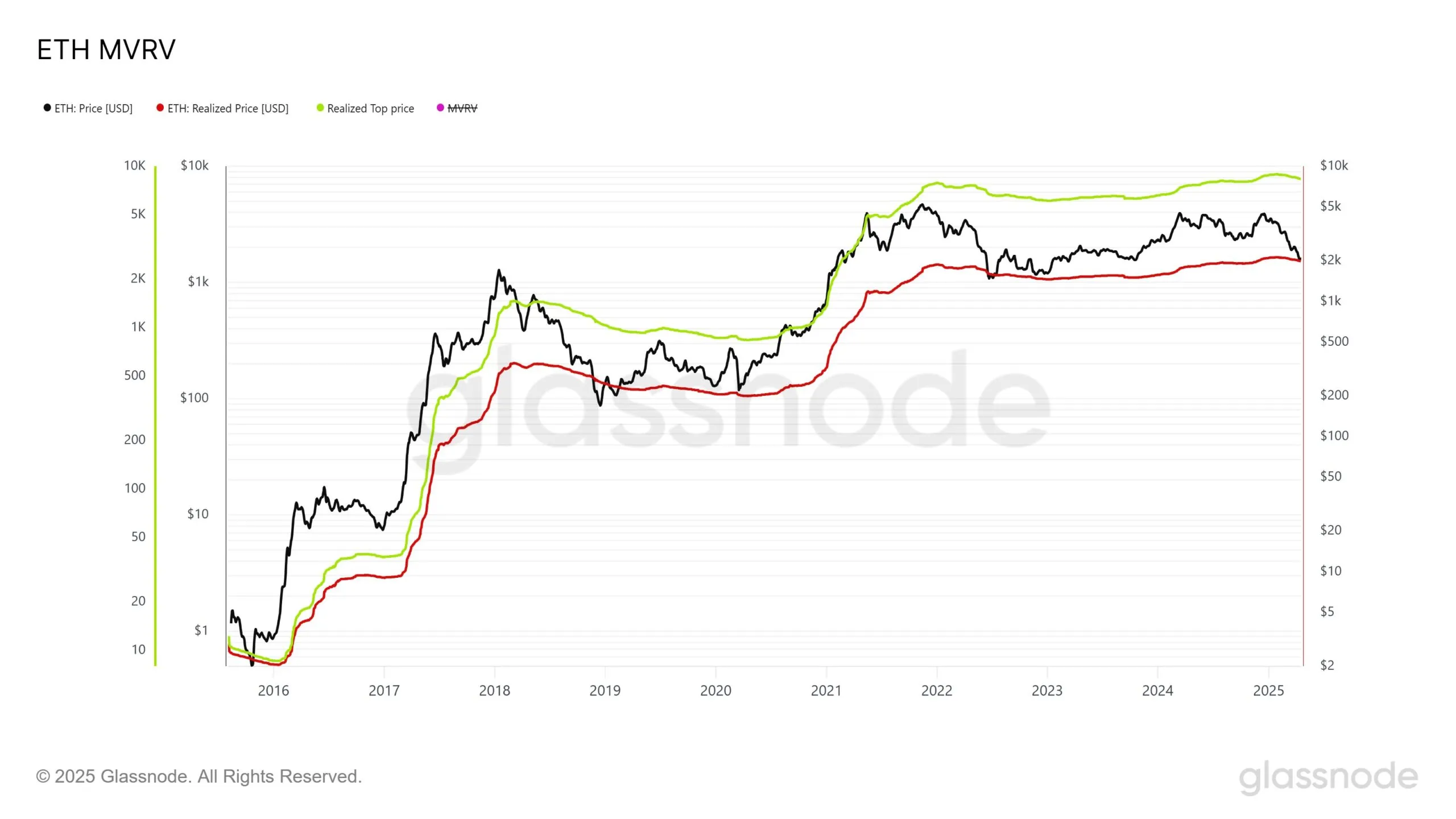

A key point raised by Venturefounder was that Ethereum’s market value has aligned with its on-chain realized value. This metric reflects the average price each ETH token last moved at, and when the market price aligns with the realized value, it often indicates an infrequent buying opportunity. Historically, price rebounds tend to follow such alignments.

“Looking at this ETH long term chart. Does it make you want to buy Ethereum or sell Ethereum? Be honest,” Venturefounder commented.

Despite Ethereum’s significant drop of 60% from its peak in late 2024, the network continues to hold its position as the leading platform for decentralized applications. A recent report from BeInCrypto confirmed that Ethereum generated over $1 billion in DApp fee revenue in the first quarter of 2025. This revenue highlights the ongoing utility and demand for the Ethereum network, despite its price volatility.

Looking ahead, the anticipated Pectra and Fusaka upgrades, scheduled for the mainnet launch in May 2025 and late 2025 respectively, could also improve the platform’s performance significantly. These upgrades are expected to bolster investor confidence and fuel further growth for Ethereum, giving investors more reasons to keep an eye on this evolving market.