Bitcoin Open Interest: A Recent Sharp Drop and What It Could Mean

Data from the cryptocurrency market recently revealed a significant downturn in Bitcoin Open Interest, raising interest and speculation among traders and investors alike. According to community analyst Maartunn on X, the Open Interest—a crucial metric representing the total amount of Bitcoin positions currently held across derivatives exchanges—has plummeted a staggering 17.8% in the past week alone.

Understanding Open Interest

To grasp the implications of this drop, it’s important to first understand what Open Interest means for the crypto market. Open Interest is an indicator that reflects the total number of outstanding contracts that have not yet been settled. When this value rises, it generally indicates that investors are entering into new positions, often increasing the leverage they employ. This influx of fresh positions can lead to heightened volatility in Bitcoin’s price, making the market more unpredictable.

Conversely, a reduction in Open Interest indicates that traders are either voluntarily closing their positions or facing liquidations due to falling prices. A decline in Open Interest can often lead to more stable price action, as fewer participants are left exposed to market fluctuations.

Charting the Decline

The recent data shared by Maartunn illustrates this trend vividly. The 7-day average of Bitcoin Open Interest has dipped sharply into the negative territory, signifying a considerable number of positions evaporating from the market. This trend is visually represented in a chart that highlights downward spikes over the past two years, suggesting historical patterns surrounding such a dramatic shift.

Interestingly, the past occurrences of similar deleveraging have often coincided with what could be termed as market bottoms for Bitcoin. Thus, the recent downturn has led some analysts to speculate that it could represent a potential buying opportunity for savvy investors.

A Broader Market Perspective

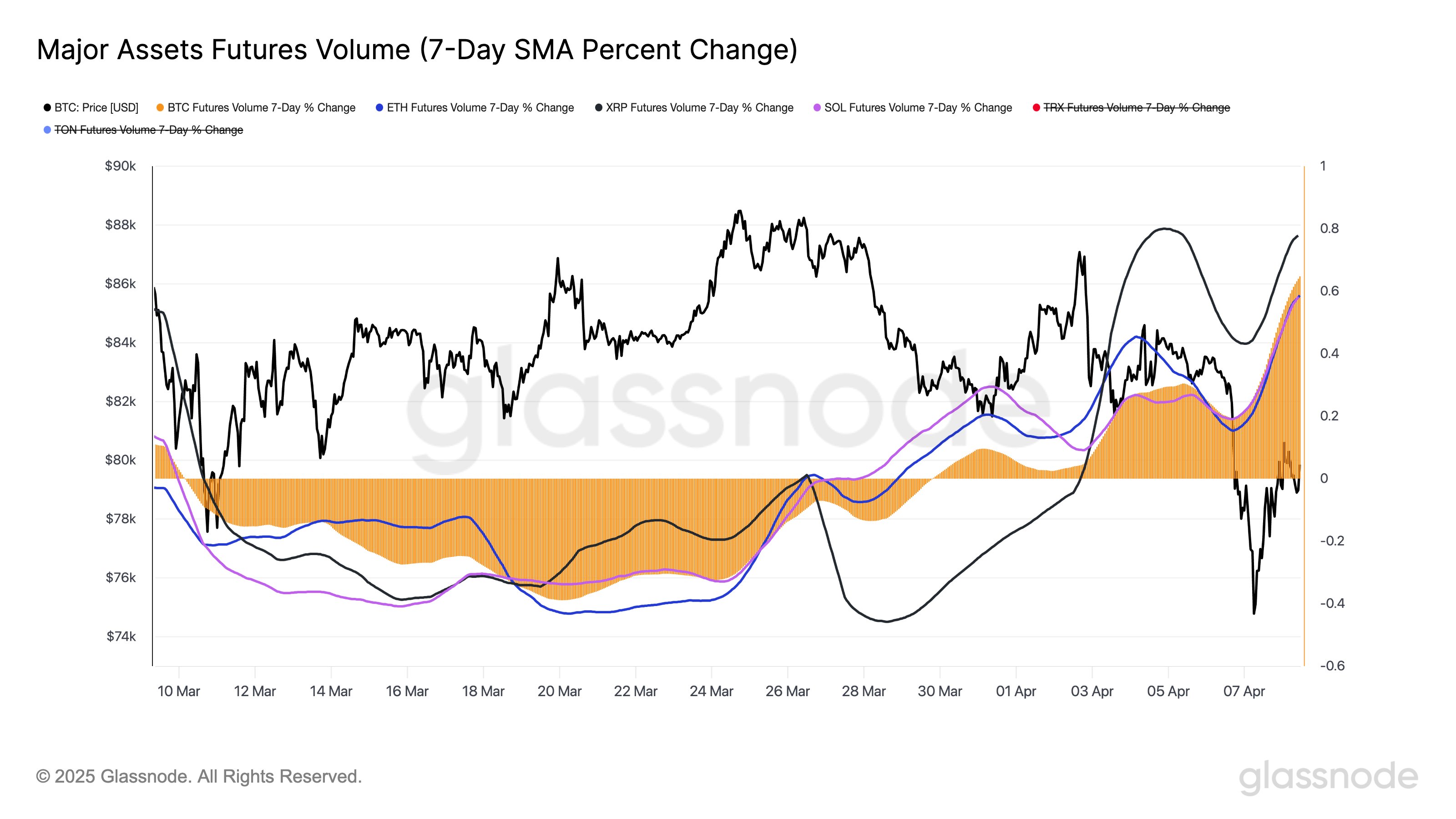

The situation surrounding Bitcoin Open Interest is further complemented by insights gleaned from futures market activity. Analytics firm Glassnode recently noted changes in futures volume across major digital assets, including Bitcoin, Ethereum, XRP, and Solana. While the futures volume saw a decline last month, it has recently reversed direction.

In the past week, the futures trading volume on derivatives exchanges has risen significantly for these cryptocurrencies, with Bitcoin volume increasing by 64%, Ethereum by 58%, XRP by 78%, and Solana by 58%. These noteworthy spikes suggest a renewed speculative interest in these digital assets, highlighting an increasingly active trading environment as investors respond to the recent volatility.

Current Bitcoin Pricing Dynamics

As of now, Bitcoin is trading around $77,900, reflecting a nearly 5% increase within the last day. The price momentum is buoyed by the renewed interest from traders, likely influenced by the recent changes in Open Interest and the broader upswing in futures trading volumes.

Speculation and Market Sentiment

The recent drop in Bitcoin Open Interest, alongside rising futures volumes, paints a complex picture of the current crypto landscape. Many traders might interpret the drop as a sign of capitulation or exhaustion, potentially resulting in a price rebound as the market stabilizes. However, others may remain cautious, observing how the market reacts to these changes in Open Interest.

Understanding these layers of market activity can equip traders with insights critical to navigating the heightened volatility and potential trading opportunities presented by the cryptocurrency market’s current climate. As interest in Bitcoin continues to evolve, both seasoned investors and curious newcomers will be keenly watching these indicators to inform their trading strategies.

Disclaimer: For informational purposes only. Past performance is not indicative of future results.