As reported by CoinCodex, Dogecoin (DOGE) has recently emerged as the star performer in the cryptocurrency sphere, particularly among the top 10 cryptocurrencies by market capitalization. Over the past 24 hours, DOGE’s price surged by 6.9%, and it experienced a weekly increase of 10.1%. However, it’s worth noting that there was a slight dip of 1.2% over the last month. In comparison, both Bitcoin (BTC) and Ethereum (ETH) are struggling to keep pace, with BTC rising just 0.5% over the past 24 hours and 3.1% weekly, while ETH faced a minor decline of 0.1% daily and a more significant 2.4% weekly downturn.

Why Is Dogecoin Outshining Bitcoin and Ethereum Right Now?

Several intriguing factors are contributing to Dogecoin’s impressive performance in the cryptocurrency market. To begin with, the buzz surrounding Elon Musk’s attorney, Alex Spiro, chairing a $200 million Dogecoin (DOGE) fund is creating a ripple effect. In recent months, corporate treasuries have played pivotal roles in propelling cryptocurrencies like Bitcoin and Ethereum, which have gained widespread adoption among institutional funds. Fans of DOGE are now hoping to see a similar pattern unfold for their favorite memecoin as institutional interest swells.

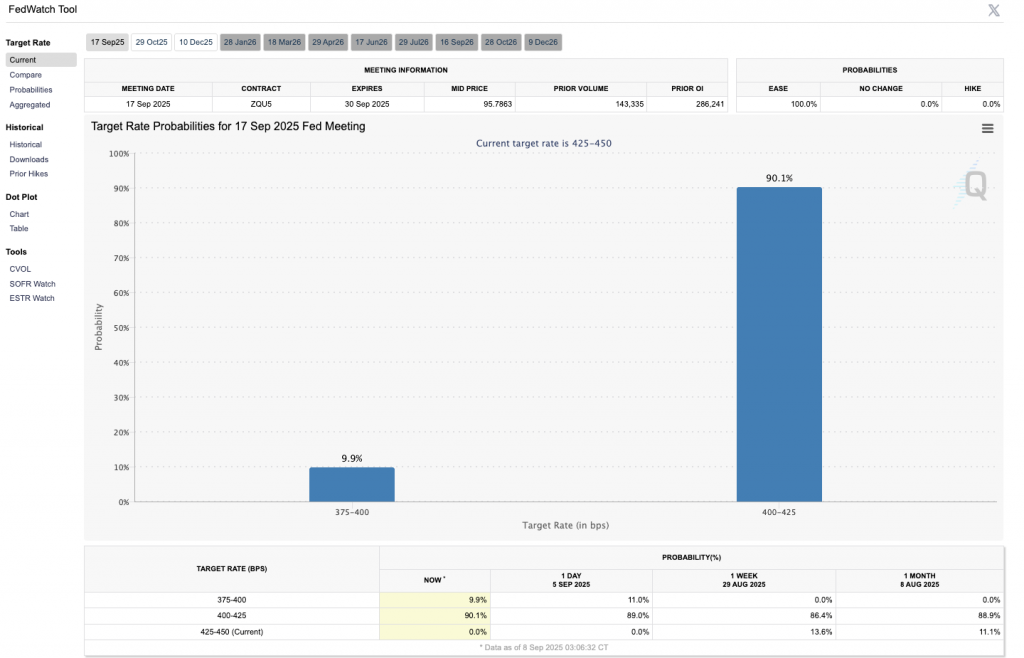

Adding fuel to the fire is the speculation around a possible interest rate cut later this month. Historically, rate cuts have encouraged investors to take on more risk, and for many, Dogecoin epitomizes a high-risk, high-reward investment. The current sentiment is partially fueled by data from the CME FedWatch tool, indicating a 90.1% probability of a 25 basis point cut, with only a 9.9% chance for a more substantial 50 basis point reduction. As investors digest these probabilities, optimism in the crypto market is seemingly building.

Moreover, the prospect of a spot Dogecoin ETF (Exchange-Traded Fund) stands as another promising factor for the crypto. Firms like Grayscale, Bitwise, and 21Shares have submitted applications to the SEC for a DOGE ETF. If approved, this would make Dogecoin the first memecoin to gain such status, potentially attracting larger institutions and retail investors alike. This enthusiasm surrounding ETF approval may be yet another reason why investors are flocking to DOGE, eager to capitalize on any potential future gains.