Solana (SOL), EOS, and Jupiter (JUP) are three Made in USA coins making headlines this week with sharply different trajectories. Solana has dropped below $100 amid market volatility and tariff-driven uncertainty.

In a dynamic market filled with fluctuations and uncertainties, these three cryptocurrencies are facing unique situations. While Solana struggles to maintain its position, EOS is soaring with significant gains, and Jupiter remains an influential player despite a challenging environment. Each coin’s performance reflects broader market trends as well as specific responses to current economic conditions.

Solana (SOL)

Recently, Solana has dropped over 10% in the past 24 hours, briefly dipping below the $100 mark. This rapid decline isn’t just an isolated incident; it mirrors a weakness across the entire crypto market, exacerbated by external factors, including recent tariffs imposed during Trump’s administration.

Over the last week, SOL has lost more than 18% of its value, and in a surprising turn of events, it was recently overtaken by Ethereum in DEX volume, a space it had dominated for several months. This shift showcases the increasing competition within the decentralized finance sector and raises concerns about Solana’s future traction.

The outlook for SOL is somewhat concerning. If bearish momentum continues, it could retest the $95 support level. A break below that could lead to further declines toward $90. However, some analysts are optimistic; should there be a trend reversal, the token could push toward resistance at $112. A decisive breakout at this level may trigger bullish momentum, potentially bringing SOL back toward $124 or even $136, ultimately allowing Solana to reclaim its status as a leading Made in USA coin.

EOS

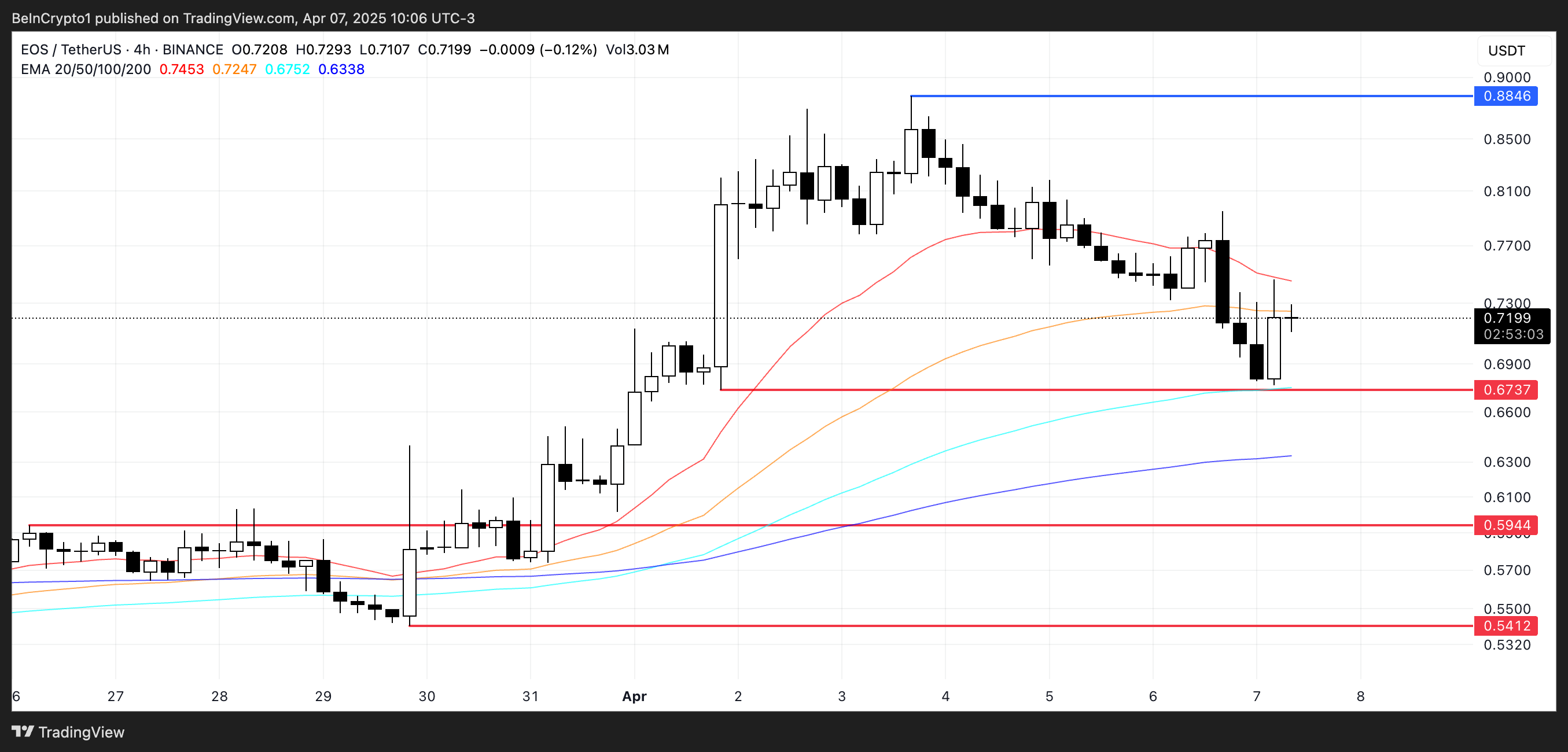

In sharp contrast to Solana’s struggles, EOS stands out as one of the few Made in USA coins posting gains this week, having climbed nearly 15% over the past seven days. Its market cap has now soared close to $1.1 billion, positioning it among prominent players like Maker, Story, Optimism, and Arbitrum.

If this upward momentum holds despite the overarching correction in the broader market, EOS could aim higher to test resistance around $0.88. If it breaks above $0.90, the road to challenging the $1 mark becomes less daunting. Conversely, however, if market sentiment swings negatively, EOS might follow the market downtrend, potentially falling back to support at $0.67. A failure at this level could open the door to further declines towards $0.59 or even $0.54.

Jupiter (JUP)

Jupiter, Solana’s top aggregator, has faced its own challenges, with its market cap dropping below $1 billion after suffering a more than 10% decline in the past 24 hours. Its price now hovers near its all-time lows, prompting concerns among investors.

Despite the price drop, Jupiter maintains its status as the leading aggregator in the crypto market, boasting an impressive trading volume of $8.98 billion over the past week—significantly more than the volumes of the next nine aggregators combined. This dominance illustrates both the platform’s importance and the disparity between trading volume and token price.

In terms of protocol efficiency, Jupiter also ranked as the fourth-largest in terms of fees generated over the last week, bringing in $14 million—just behind Tether, Circle, and Pump. It offers insights into the liquidity and activity within the crypto ecosystem, reflecting varying user behaviors amid price volatility.

However, the outlook isn’t entirely rosy. If the downtrend continues, Jupiter could fall below the $0.30 mark, setting new lows for investors. On the other hand, regaining bullish momentum might pave the way for the token to climb back to $0.35, $0.41, and potentially retest the $0.50 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.