The global cryptocurrency market recently shattered expectations by breaking the $4.18 trillion mark on October 3rd, a historic milestone that added over $118 billion to its valuation. This surge occurred as Bitcoin approached new price discovery levels at $124,000 and Ethereum surged past $4,400. Just days before this surge, many analysts believed the cryptocurrency bull market was tapering off, making this revitalized momentum particularly noteworthy as we enter the final quarter of the year.

Across the board, nearly all cryptocurrencies are performing well, transforming the weekly financial landscape. Bitcoin itself has seen an impressive 11.25% rise lately, while BNB (Binance Coin) has emerged as the top-performing altcoin with a significant 22% increase over the past week. This resurgence has sparked speculation that Bitcoin could re-enter price discovery mode, as altcoins also gather momentum.

Interestingly, the digital assets market appears to be resilient, seemingly unaffected by the current government shutdown in the United States. While initial sentiments suggested that the shutdown would drive investors away from riskier markets, the recent uptick in crypto performance indicates a different trend. This encouraging behavior can potentially be traced back to macroeconomic shifts.

U.S. Treasury yields, particularly short-term yields, have been taking a notable dip this week. With growing expectations for an interest rate cut by the end of the month, investors are increasingly pivoting toward markets that offer more volatility and opportunity. As 10-year Treasury yields flirt with the 4% mark, the 2-year yields are currently at around 3.576%. This environment is exceptionally favorable for cryptocurrencies, which thrive in liquidity-rich contexts. Signs suggest that the market might already be pricing in the prospect of lower borrowing costs.

Altcoin Season Warming Up?

The altcoin market cap has gained traction, outpacing Bitcoin in terms of profit since October 1st. Altcoins collectively recorded a 7.02% increase, compared to Bitcoin’s 6.45%. Discussions about an “altseason” have been prevalent throughout the year, and it’s noteworthy that altcoins are currently outperforming Bitcoin at the onset of a bull run, a relatively uncommon trend in the crypto sphere.

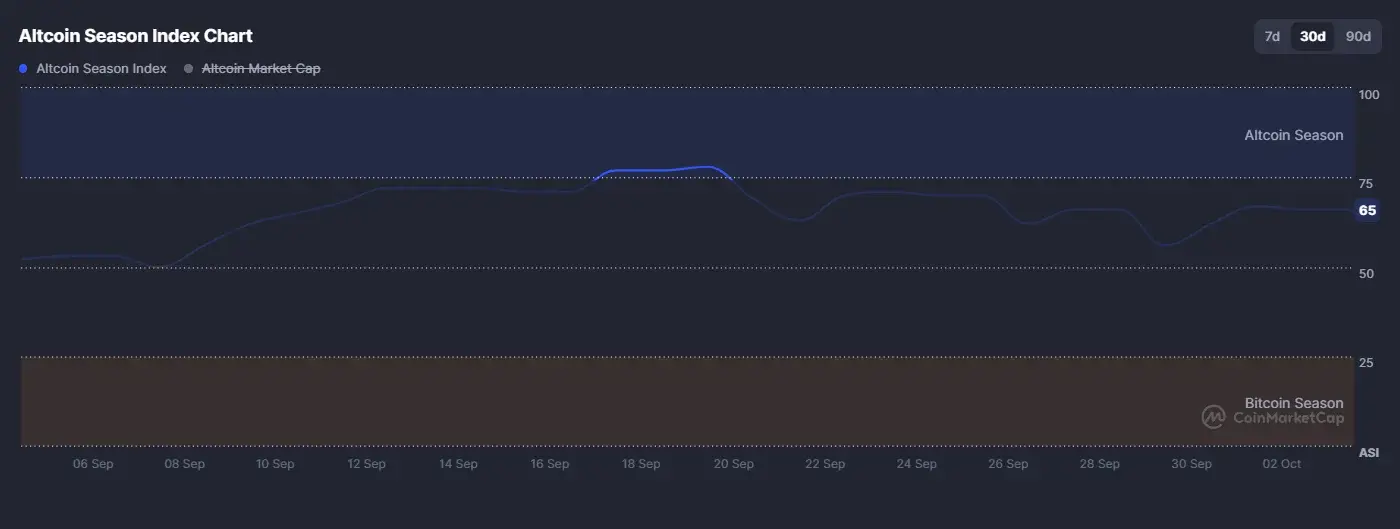

According to CoinMarketCap’s “Altcoin Season Index,” which measures the performance of the top 100 altcoins against Bitcoin, the index has remained just below the 75 threshold during the week, currently resting at 65. This suggests a healthy upward momentum, and traders will be closely monitoring this index for further signs of altcoin dominance.

Highlighting some standout performances, Aster, Myx Finance, and Memecore have emerged as the best-performing altcoins over the last 90 days. In stark contrast, DoubleZero, Virtual Protocols, and Pi Network have notably trailed behind as the weakest performers in this quarter.

ETF Inflows and Market Optimism

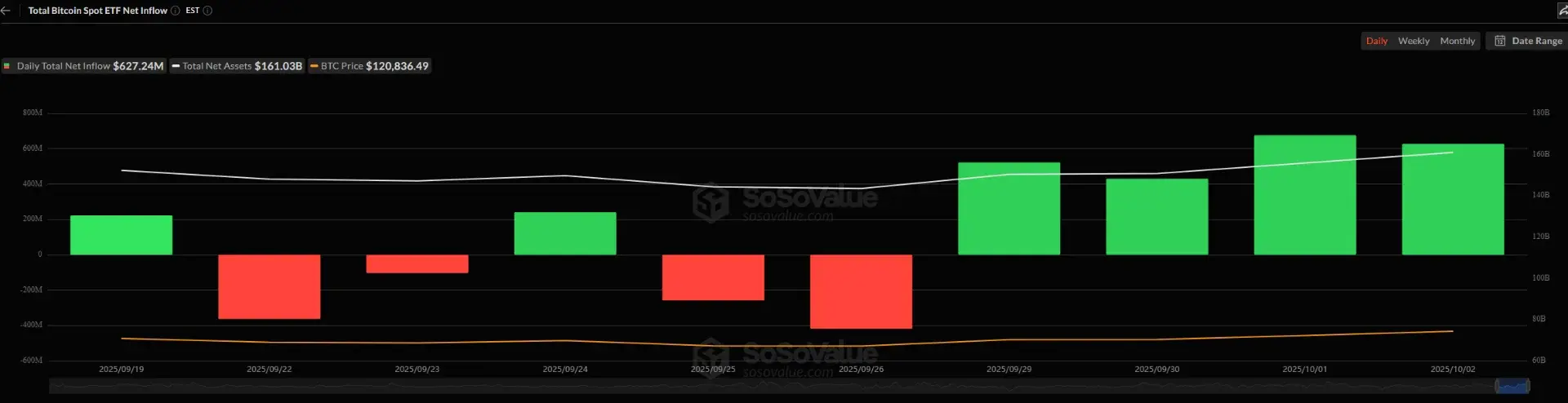

In a significant market shift, Bitcoin exchange-traded funds (ETFs) ended a streak of consecutive outflow days on September 29. Since then, these ETFs have attracted nearly $1 billion in inflows, indicating a renewed investor interest in Bitcoin.

Meanwhile, Ethereum ETFs have experienced even more substantial inflows, with over $1.8 billion flowing in since September 29. Notably, BlackRock’s ETHA ETF has played a significant role, bringing in more than $1.06 billion in just five days.

These robust performances in digital assets and crypto ETFs have reshaped investor sentiment dramatically. What began as a week marked by “fear” on CoinMarketCap’s “Fear & Greed Index” has quickly transformed into a phase approaching “greed,” underscoring how rapidly market momentum can shift when liquidity returns.

Looking ahead, next week is poised to be crucial for financial markets. Fed Chairman is scheduled to deliver a public statement on Thursday, while the Non-Farm Payroll (NFP) data expected on Friday could further solidify expectations surrounding lower interest rates, adding an extra layer of anticipation among investors.

On a related note, WEEX is currently rewarding new traders with a 20% Welcome Bonus when joining through this link.