SEC Scales Back Crypto Enforcement Efforts

In a significant shift within the regulatory landscape of cryptocurrencies, the Securities & Exchange Commission (SEC) has announced a reduction in its dedicated unit of lawyers and staff members focusing on crypto enforcement actions. This decision has drawn notable reactions from various stakeholders within the cryptocurrency industry. Among these voices is Stuart Alderoty, Chief Technology Officer (CTO) of Ripple, who has expressed renewed optimism regarding the potential resolution of the high-profile SEC vs. Ripple lawsuit. Alderoty’s positive sentiment underscores a broader anticipation within the crypto community regarding the clarity that could emerge from such cases, which have long influenced market dynamics and investor confidence.

Bitcoin’s Price Movement and Family Influence

In the latest price action, Bitcoin (BTC) showed signs of recovery, trading just above the $98,000 mark after a steep dip of nearly 5% over the preceding two days. Factors contributing to this brief resurgence include a notable endorsement from Eric Trump, who has advocated for the inclusion of Bitcoin in the cryptocurrency portfolio of the family-backed World Liberty Financial (WLFI). This endorsement may serve as a catalyst for Bitcoin’s current recovery trajectory, appealing to both seasoned investors and newcomers alike.

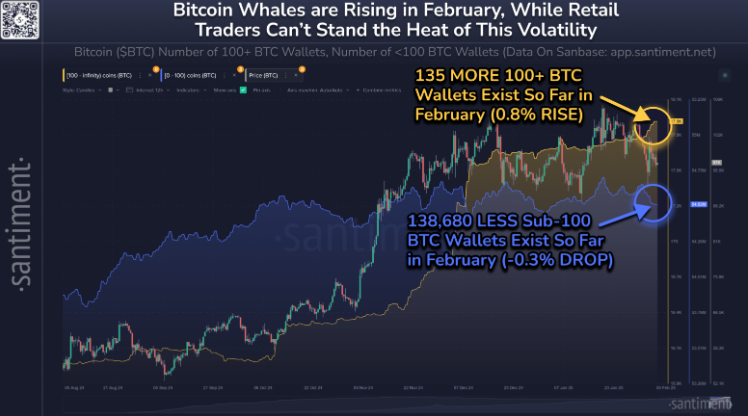

Additionally, insights from Santiment highlight an intriguing trend where Bitcoin whales are accumulating more BTC amidst recent downturns. The data indicates that while retail traders face liquidation, large holders are capitalizing on lower prices to strengthen their positions. This dichotomy between retail investors and whales paints a picture of an evolving market landscape, hinting at potential bullish trends on the horizon as the investor dynamics shift.

Current Market Consolidation

Despite some signs of recovery, the cryptocurrency market as a whole remains on a cautious path. With a total market capitalization hovering around $3.3 trillion, it’s evident that the sector is undergoing a phase of consolidation, having previously reached approximately $3.5 trillion and briefly flirting with the $3.8 trillion mark just a few weeks ago. This pattern of consolidation reflects the market’s volatility and the ongoing adjustments investors make in response to market sentiment and regulatory developments.

As the cryptocurrency ecosystem continues to mature, participants are keenly aware that market shifts can occur rapidly, shaped by both internal dynamics and external factors like regulatory changes and influential endorsements. The current state of the market is a reminder of the importance of vigilance and adaptation in this fast-paced financial frontier.

Through these developments, traders and investors in the cryptocurrency market are left grappling with hopes for regulatory clarity alongside the ongoing fluctuations that define the crypto experience.