XRP is currently experiencing a shift in momentum, transitioning from a recent bullish position into fresh bearish pressure. Simultaneously, Shiba Inu (SHIB) has encountered its infamous Evil Zero pattern, stirring unease among traders and elevating volatility across the crypto landscape.

This article delves into the latest price movements, key technical levels, and what to monitor next, drawing from market analyses provided by TradingView and Bitget.

XRP Faces Market Pressure Amid Bearish Momentum

XRP has reversed direction following a brief recovery, reflecting renewed downside pressure on daily charts. According to TradingView, the token has dropped approximately 1.7% in the latest trading session and has struggled to stay above crucial resistance levels around $2.50–$2.70.

As sellers reestablished their hold on the market, XRP (XRPUSD) slipped below vital moving averages, implying that bearish momentum might continue unless buying pressure resumes.

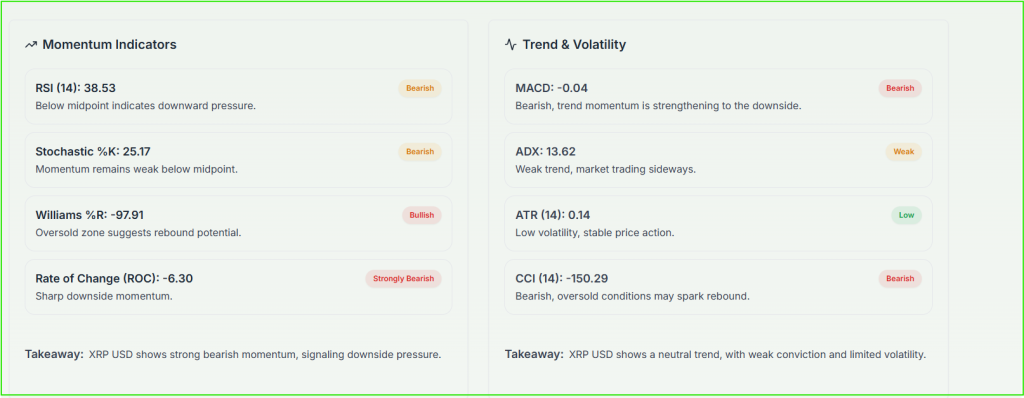

Why is XRP losing steam at this moment? The primary factors appear to be weak buying momentum combined with increasing selling pressure. Technical indicators such as the RSI and moving averages suggest limited chances for upside until XRP can reclaim higher resistance levels.

Key Technical Levels for XRP and Investor Sentiment

Chart analysts highlight specific levels to watch. Resistance is currently positioned near the $2.70–$2.80 range, while support appears at $2.20 and $2.00 during short-term assessments. TradingView notes that XRP has dipped below the 200-day moving average, a development that frequently signals the risk of deeper declines if not recovered.

Volume has been trending higher on selling days, with the RSI falling below neutral levels, indicating a lack of strong buying conviction.

For short-term holders, the psychological threshold of $0.50 mentioned in some analyses stands significantly lower than current pricing, yet it underscores potential long-term downside targets if the market continues to weaken.

Shiba Inu’s Evil Zero Returns to Haunt the Market

Shiba Inu (SHIB) seemed to be regaining momentum but faced the unsettling resurgence of the Evil Zero pattern when its price slipped beneath crucial short-term support levels. TradingView describes this drop from the $0.0000099 support towards $0.0000090, with lower support residing around $0.0000085.

The “evil zero” represents a trader’s fear of losing a key digit in price notation, which can deliver a psychological blow to retail investors holding meme coins.

Why is the Evil Zero significant? This pattern reflects declining confidence in meme assets among retail investors and can incite rapid sell-offs if fear escalates.

Ripple Effects on Bitcoin and Altcoins

The broader market has also suffered, as Bitcoin’s recent gains have dwindled, leading to declines in altcoins. As noted by TradingView, Bitcoin’s reversal from higher price ranges has added to risk aversion, affecting altcoins such as XRP (XRPUSD) and SHIB.

When Bitcoin shows weakness, liquidity tends to contract, prompting short-term traders to exit their positions en masse.

This market dynamic contributes to overarching bearish setups throughout the crypto industry.

AI Stock trading bots and sentiment algorithms are detecting an uptick in short positions along with heightened selling volume, a trend that can exacerbate declines in less liquid markets.

Crypto Analysts Warn of Market Correction Risks

Market notes from Bitget indicate that bearish forces have reasserted control following a brief recovery period. Analysts point to rising sell volumes, losses falling below significant moving averages, and diminishing momentum as signals that a correction phase may be imminent.

This aligns with recent technical analyses showing a downward RSI and sellers dominating daily sessions. Traders ought to proceed with caution and remain vigilant for any sudden liquidity vacuums.

What are experts predicting for near-term risk? Analysts caution that unless XRP can reclaim the $2.70–$2.80 range with substantial volume, a downward trend towards identified support zones becomes increasingly likely, escalating correction risks for altcoins.

Comparing XRP’s Performance with Other Major Tokens

Recently, XRP (XRPUSD) has underperformed in comparison to other leading market tokens, as sellers have favored mid-cap altcoins and meme tokens. The recent correction in Bitcoin serves as a significant driver for this trend; altcoins generally follow Bitcoin’s course.

Ethereum, Cardano, and Solana have also faced pressure; however, XRP’s distinct technical framework, characterized by a descending channel and failure to surpass the 50-day moving average, renders it particularly susceptible.

Traders are advised to consider macroeconomic factors, liquidity cycles, and order book depth while juxtaposing various token trajectories. AI Stock Analysis methodologies can quantify these dynamics, benefiting both trading strategies and risk management.

Online trading communities exhibit mixed sentiments. The XRP community acknowledges the current technical challenges but remains optimistic about the long-term utility of the token in cross-border transactions.

On the other hand, members of the SHIB Army express discontent over the Evil Zero backlash, though some view token burns and outflows from exchanges as signs of bullish potential in the long run. Exchange sentiment metrics indicate increased withdrawals of SHIB tokens, a factor that analysts interpret as a reduction in immediate selling pressure, though it does not negate near-term volatility risks.

What Traders Should Watch Next

Here are essential indicators to keep an eye on this week:

- XRP resistance levels around $2.70–$2.80 and supports near $2.20 and $2.00.

- The price action of Bitcoin, as its weakness often leads to declines in altcoins.

- Exchange flows, particularly SHIB token withdrawals, which may mitigate short-term supply pressures.

- Trading volume metrics on days of upward or downward movements, which help confirm any potential reversals.

Is a bounce-back for XRP on the horizon? A rebound is plausible, contingent on a resurgence of buying volume and XRP reclaiming its 50-day and 200-day moving averages. In the meantime, traders should prepare for potential fluctuations and wider intraday swings.

FAQ’S

XRP is currently showing bearish momentum, with analysts noting a shift from earlier bullish trends due to weak trading volumes and broader crypto market pressure.

Experts say it’s highly unlikely in the near term. Shiba Inu’s large token supply and slow-burning rate make such a price target nearly impossible without a major supply reduction.

No, Elon Musk has denied owning Shiba Inu (SHIB). Although his tweets sometimes influence meme coins, there’s no evidence of his investment in SHIB.

Analysts suggest Bitcoin and Ethereum remain the strongest contenders, while XRP faces stiff competition. A 2025 poll shows Bitcoin leading investor confidence across major altcoins.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.